Don Shurley, UGA Professor Emeritus of Cotton Economics

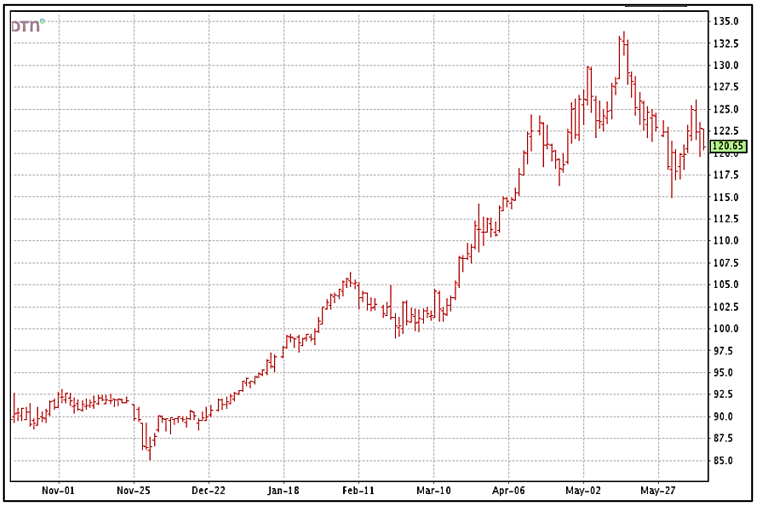

December futures have been ranged between roughly $1.17 and $1.32 for over 2 months—reaching 3 consecutive new contract highs before taking a downturn over the past month. After making somewhat of a recovery back to the $1.25 area, price has weakened again.

The outlook is not necessarily for lower prices. Anything is still possible including a return to previous highs. But, there seems to be increasing forces that may prevent that from happening.

Acres and Crop Conditions. As of June 12, the crop was 90% planted—2 percentage points ahead of average. Overall, the crop was rated 45% Good to Excellent—down slightly from the previous week. The Texas crop was rated 29% Poor to Very Poor. Drought maps suggest that conditions in West Texas have improved only slightly despite recent rains. So, the crop will likely remain vulnerable and a factor to consider.

USDA’s first estimate of actual acres planted will be out on June 30. The current “planting intentions” number is 12.23 million acres—9% above last year. If the June 30 number is higher, that may weaken prices—but, a higher number is not necessarily bad for prices longer term—it ultimately depends on crop conditions and related yield and acres harvested and the demand situation.

US Exports. Exports for the 2021 crop year are projected at 14.75 million bales. We are not on pace to reach that level. If exports come up short of the projection, this would increase stocks to carry in to the 2022 crop year on August 1. This would take some of the impact off, if the US crop is coming in short and/or if demand is good.

Exports need to average roughly 433,000 bales per week. In the most recent report, for the week ending June 2, exports were 357,400 bales.

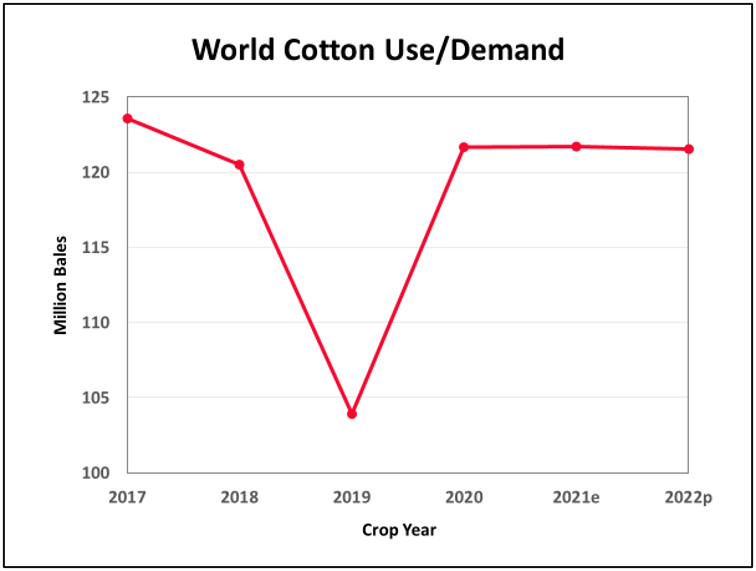

Demand and Economic Concerns. The USDA June supply and demand report last week adjusted use for the 2021 crop year down by 1.25 million bales. Use for the upcoming 2022 crop year is currently projected at 121.54 million bales—slightly lower than for the 2021 crop year and the last 2 years.

Demand is beginning to be a concern. The US crop situation is helping keep prices at a high level despite these concerns. The 2021 crop year Use was lowered; Use for the 2022 crop year lowered 450,000 bales from the initial projection last month.

Some of the decline in price recently is related to declines and losses in the US stock market. This can also impact commodities. There are concerns about the direction of the US economy.

I am not preaching gloom and doom—just laying out scenarios. Price direction depends on, among other things, the outcome for the US crop and demand. We’ve got a long way to go.

=