Don Shurley, UGA Professor Emeritus of Cotton Economics

Crop uncertainty has taken a back seat. Economic and demand fears have taken control. December 2022 futures closed today at 83.71 cents. The chart below clearly shows the blood bath this market has taken in just the past month.

–

The market is reacting to the “prospects” for weaker demand. Such weakness has yet to be confirmed but the market is reacting to the signals of what may be yet to come.

- US stock market declines

- Recessionary fears

- Inflation, including the latest data being worse than expected

- High inflation driving the dollar higher, making US exports (imports from the US) more expensive

- Outlook for weaker demand from China including increasing COVID19 and related lockdowns

–

With these “fears” already impacting the market, USDA’s July supply/demand report released earlier this week seemed to support a weaker outlook. In summary, here are highlights of the US and World numbers:

- Surprisingly, US exports for the 2021 crop year ending July 31 were unchanged at 14.75 million bales, despite the clear fact that we are not on track to meet that.

- The forecast for the 2022 US crop was lowered 1 million bales from the June estimate. Overall acreage abandonment was increased to 31%.

- US exports for the 2022 crop year beginning August 1 were reduced ½ million bales.

- World Demand/Use for the 2021 crop year was lowered almost 2 million bales from the June estimate. This raises the old crop inventory carried over into the 2022 crop year.

- Projected World Use/demand for the 2022 crop year was revised down 1.62 million bales including ½ million bales each for China and India and 600,000 bales combined for Bangladesh and Vietnam.

- China imports were lowered ½ million bales.

The US crop continues to be uncertain and although not getting much attention right now, will eventually also come more to bear in the market. When the demand side takes a hit, the supply side can become less crucial in the balance of things.

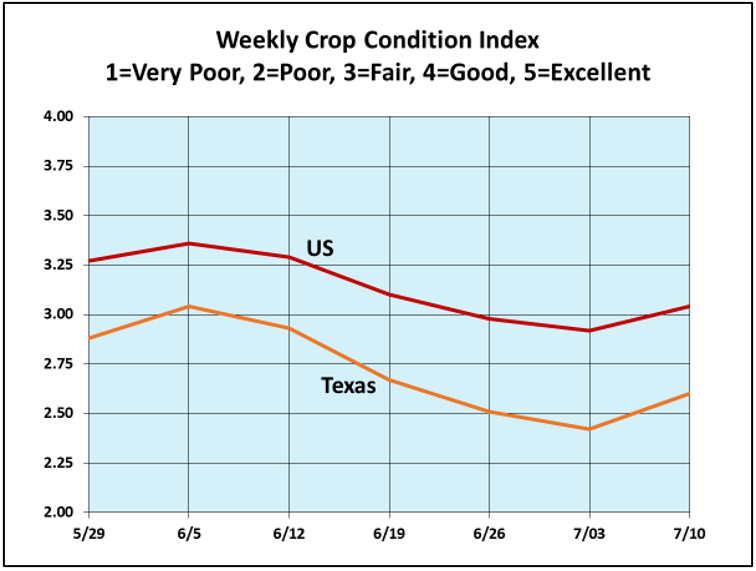

The latest crop condition as of July 10th show the overall condition of the US and Texas crops both improved from the prior week. Still, 41% of the Texas crop is in Poor to Very Poor condition. Overall, the US crop is 39% Good to Excellent.

–

Prices could still move lower but there should be support at 82 to 85 cents. Some producers are already up to 50% priced averaging $1 or better. For most, crop uncertainty likely has them on the sidelines from doing any additional prices right now. Still, and especially for producers unpriced or with little priced, the price destruction that has taken place is very concerning as it should be.

Unless a producer wants to bet on future price direction with Puts or Calls, it seems to me at least one feasible strategy right now is to hope the low is set and prices will correct higher. I don’t expect a full return to where we were, however.

–