Don Shurley, UGA Professor Emeritus of Cotton Economics

Prices have recovered, it’s not yet as high a recovery as we hope for, but we’re currently up over 10 cents from the low.

=

Prices seem to be “wobbling” mostly between 90 and 96 waiting for more definitive signals to verify direction. Higher price opportunities (98 or better) are possible and downside risk (below 87) seems limited. BUT, anything is possible. We’re in a balancing act between US crop uncertainty on the supply side and economic and recession worries on the demand side.

=

Exports

This week’s export report (for the previous week ending July 28) was horrible. Yet, and I’m surprised, the market seemed to either not notice or was more focused on other factors.

The 2021 crop marketing year ends July 31. USDA’s projection is we’ll export 14.75 million bales for the year. Through July 28, exports are 13.92 million. It looks like we’ll come up around 670,00 bales short of USDA’s projection.

If realized, we’ll carry 670,000 bales more old crop into the 2022 marketing year beginning August 1. It seems to me a larger carry-in could take at least some pressure off crop condition concerns. But as I’ve already said, the market hasn’t yet reflected this.

=

Demand

Prices seem to switch back and forth, sometimes focused on supply side, sometimes demand side. Recent price hemorrhaging was caused largely by economic/demand concerns.

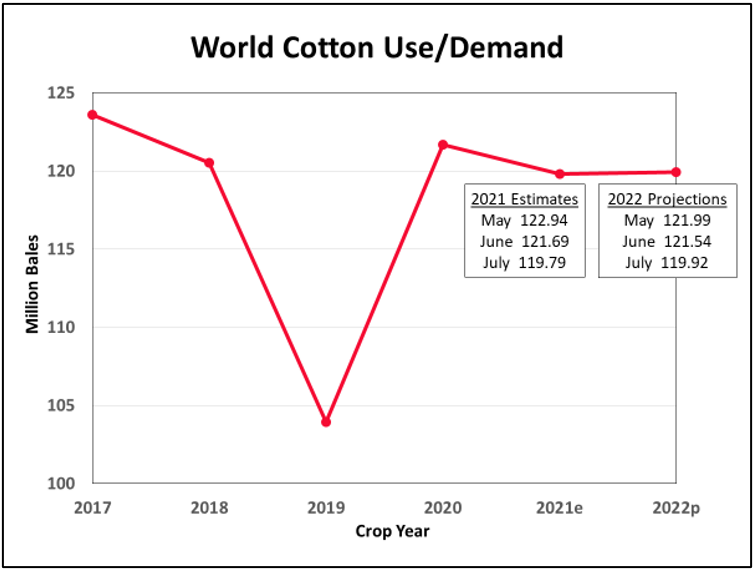

USDA’s monthly USDA world use/demand numbers show the erosion in demand. Use for the 2021 crop year has been revised down 3.15 million bales or 2.6% since May. Projected Use for the 2022 crop year has been lowered 2.07 million bales or 1.7%.

=

August Report

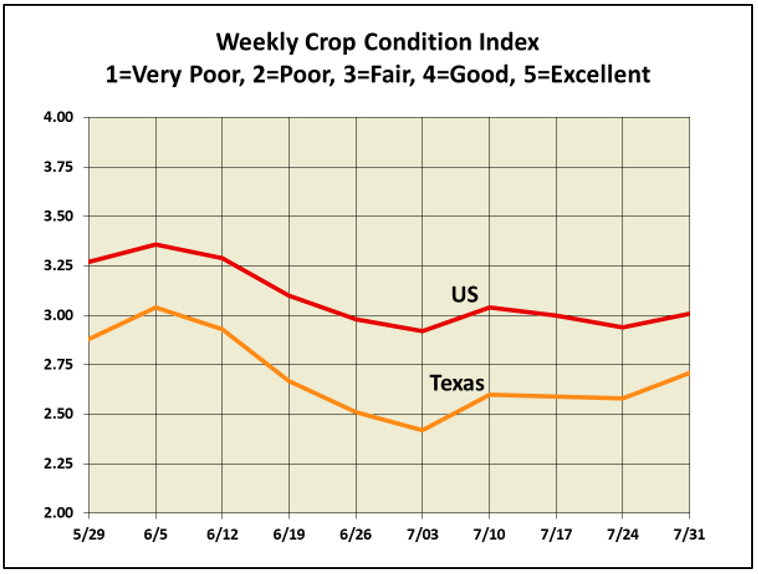

The 2022 US crop is projected at 15.5 million bales. Many expect the crop to get smaller beginning with USDA’s August estimates. The latest crop conditions show improvement but a less than 15.5 million crop seems to be the expectation. A smaller crop could be offset by a larger carry-in and/or a reduction in expected US 2022 crop year exports due to demand.

=

Prices

Price direction should begin to take a firmer path over the next few weeks.

=

- Cotton Marketing News:Acreage Numbers are a Surprise – What Now? - July 11, 2025

- Gulf Coast Cattlemen’s Conference – August 8 - July 11, 2025

- Cotton Marketing News:USDA June Numbers—Neutral, Not Good but Not Bad - June 20, 2025