Don Shurley, UGA Professor Emeritus of Cotton Economics

We’ve learned and experienced the evidence of how crop markets, especially cotton it seems, can be impacted by “secondary” factors on the demand side. Factors that one may think have little or nothing to do with cotton but, in reality, can be thought of as a proxy of how things are going on the consumer and demand side—such factors as the value of the dollar, inflation, interest rates, the US stock market, and COVID impacts here and abroad.

–

–

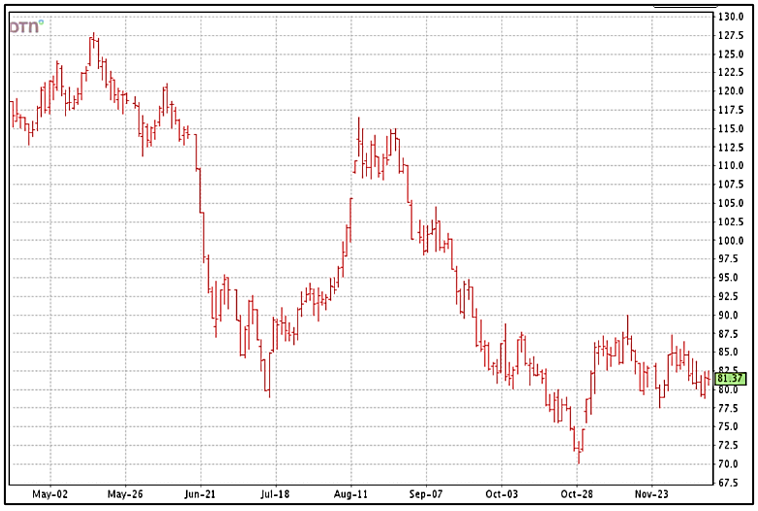

Prices for remaining 2022 crop on the March futures currently seem to be bound in a range of mostly 78 to 87 cents. Prices are in a downtrend right now and in the lower part of that range at around 81 to 82 cents.

Prices could move lower (below 78) but prices at that level back in late October did not hold. A rally to 85 to 88 or better could be considered as a selling opportunity. Higher prices are possible but this seems limited under the current poor demand environment.

USDA’s monthly supply/demand estimates released last week also did little to help the situation.

- US crop for 2022 was increased 210,000 bales.

- US mill use for the 2022 crop year was lowered 100,000 bales and exports lowered 250,000 bales.

- So as a result, US ending stocks were raised ½ million bales.

- World production for the 2022 crop marketing year was reduced 700,000 bales…..

- But, World demand/Use was adjusted down a huge 3.25 million bales including 1 million bales each for China and India and 1 million bales total for India, Pakistan, and Vietnam.

- Imports (the need for exports from another country) were cut 2 million bales including ½ million bales for China, 400,000 bales for Turkey, and 200,000 bales for Vietnam.

US export sales and shipments are another signal of demand. Sales over the past month have been especially poor even at these low prices. Shipments have also been low. Shipments need to average 236,000 bales per week to meet USDA’s latest exports projection last week. Shipments are currently running at about 57% of that pace. Shipments will pick up as the season progresses, but we shouldn’t be surprised if the USDA export projection gets lowered again.

New crop December 2023 futures are in the neighborhood of 80 cents. This does not inspire cotton acreage but much will also depend on the price of competing crops, production costs, and the individual farm situation dictating rotation and flexibility.

–

The expectation already is that acres may be down for 2023. Because of demand concerns, however, the prospect of lower acreage and production is not going to move the market. Let’s also remember that, even with lower acres, 2023 production can be greater than 2022, if abandonment is more normal.

Corn has dropped about 5% over recent months but currently still about $6.00. Soybeans have held price better—currently just under $14. Peanut contracts will be whatever they need to be to be competitive with other crops (especially cotton) and attract enough acres to meet expected demand.

–