Don Shurley, UGA Professor Emeritus of Cotton Economics

2022 (Old crop), March futures are currently in the neighborhood of 82¢/lb. and continue in a pretty much sideways pattern mostly between 80 and 86¢. The more optimistic upside appears to be at 90¢. I’d put the more pessimistic bottom at 78¢.

This week’s USDA monthly production and supply/demand numbers were not favorable for old crop situation and outlook.

- The US average yield was increased, and 2022 production increased approximately 400,000 bales.

- Projected US exports for the 2022 crop marketing year ending July 31 were cut 250,000 bales.

- World use/demand for the 2022 crop year was cut 850,000 bales including reductions for India, Indonesia, and Vietnam.

- Use in China was not changed from the December estimate but imports for China were reduced 250,000 bales.

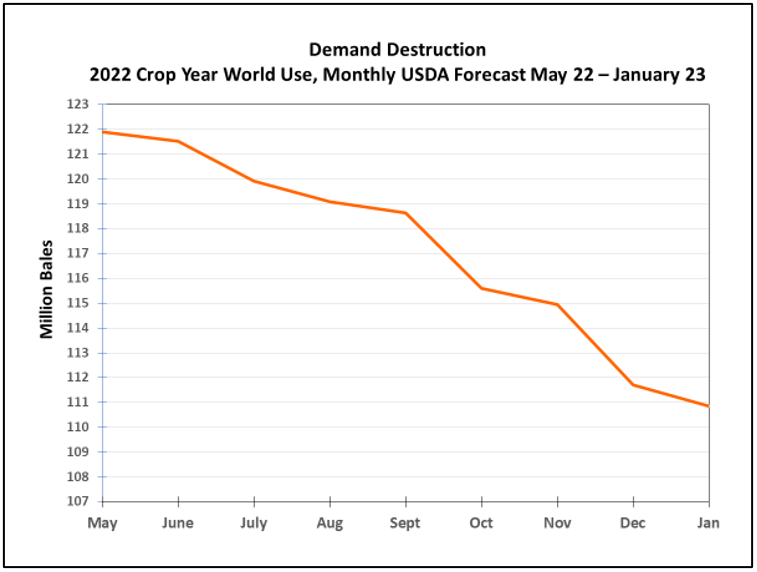

Reduced demand and uncertainty in future demand are the main culprits in the lower price situation. Back in May, USDA projected World use/demand for the 2022 crop marketing year at 121.99 million bales. Demand/use has been revised down each month since. World use is currently projected at only 110.85 million bales—a reduction of 9.1% or roughly 11 million bales.

If realized, this would be the lowest World use since 2019 and the third lowest out of the last 10 years. Compared to last year (the 2021 crop marketing year), use/demand will have gone from a projected 4% increase to a 6% decline.

In absence of equal or offsetting supply factors, it is difficult for prices to increase and sustain any increase in this environment.

–

Over the past 5 weeks, export sales have averaged 27,520 bales per week including one week with heavy cancellations. Shipments have averaged 137,210 bales. With a little over 29 weeks of data remaining in the marketing year, shipments need to average 266,000 bales per week to meet USDA’s now revised projection of 12.0 million bales for the 2022 crop marketing year.

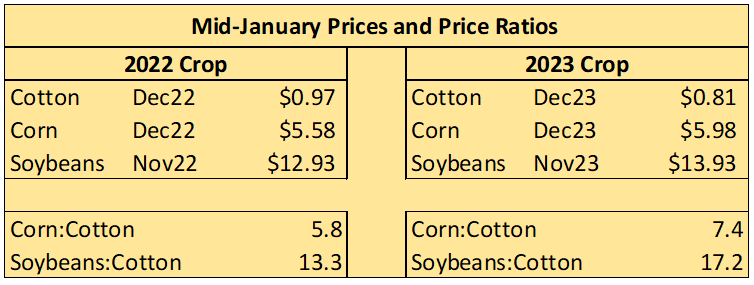

New crop December 2023 futures are currently around 81¢. Many factors determine planting decisions including price, costs, crop rotation, risk and risk management, etc. So, price and how prices compare is not the only influence on farmers’ decisions of what to plant. But price ratios now compared to this same time last year show cotton has lost ground compared to corn and soybeans.

Acreage is already expected to decline, and the market already factors that in. Production could be higher, however, if abandonment is more normal. Lower and uncertain demand will likely keep a lid on prices until more is known.

–

- Cotton Marketing News:Acreage Numbers are a Surprise – What Now? - July 11, 2025

- Gulf Coast Cattlemen’s Conference – August 8 - July 11, 2025

- Cotton Marketing News:USDA June Numbers—Neutral, Not Good but Not Bad - June 20, 2025