Don Shurley, UGA Professor Emeritus of Cotton Economics

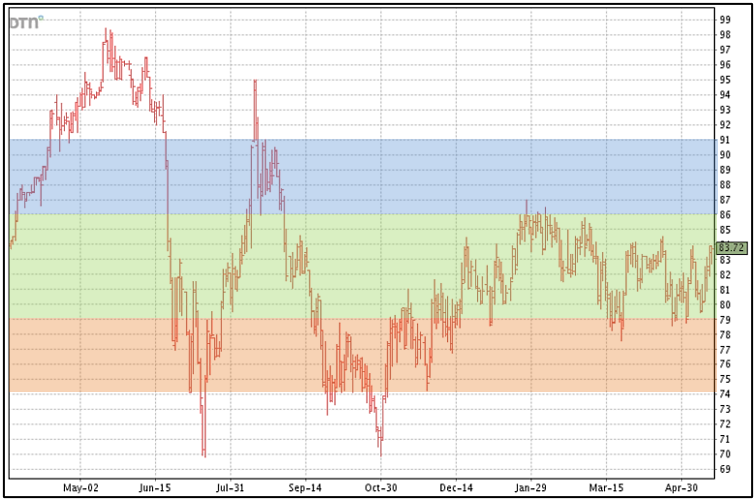

Since plummeting to the low 70’s last Fall, new crop December 23 futures have been on a roller-coaster, up then down then up again to near 86 cents by the end of January. December 23 futures have since teetered within a 5-cent range of mostly 79 to 84 cents over the past 5 months.

–

Frankly, and a good point to make, prices have weathered any negative market factors pretty well. Or to put it another way, it seems every time a negative factor knocks prices down, some positive factor comes along and pushes price back up. As recently as last week, for example, prices fell below 80 cents. Now today we’re near 84.

Given the uncertainties in both demand and supply, to be where we are at this juncture would seem to indicate the market has good support. That doesn’t mean the market won’t challenge the below 80 mark again and that’s a concern. But, to stay there would take a combination of stronger negative supply/demand factors than we’ve seen thus far.

I see 3 “levels” in this market. The “most likely” price is 79 to 86 cents. The “optimistic” price is 86 to 91 cents. The “pessimistic” price is 74 to 79 cents.

We all know that eventually farmers must begin pricing. I think it’s fair and accurate to say that none or very few want to do anything at current levels. Most farmers are waiting on something (futures or a contract opportunity) with a “9” in front and I don’t blame them. With our positive basis here in the Southeast, we’re not yet there but getting within a few cents of a 90-cent contract.

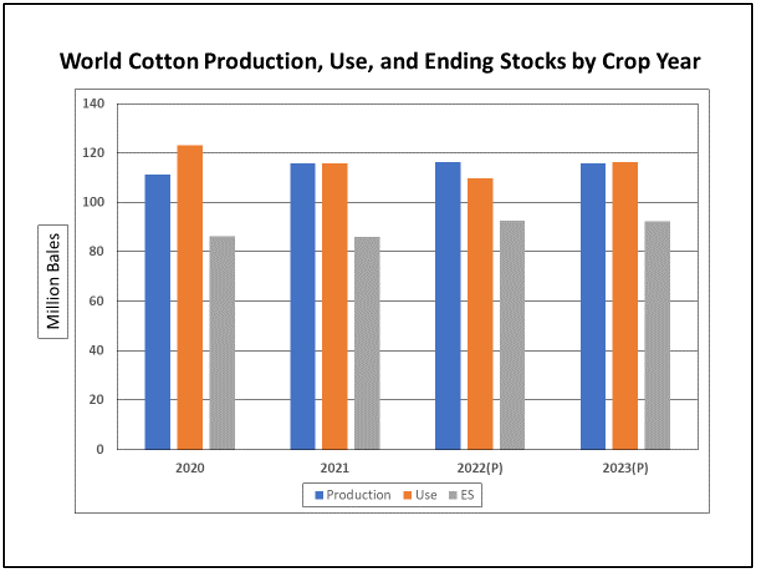

USDA’s monthly production and supply/demand reports last week were mostly supportive for prices and seem to have fueled a little more optimistic outlook. In summary:

- The 2022 US crop was lowered 210,000 bales and US exports for the 2022 crop year were raised 400,000 bales. This reduced US carry-in stocks to the 2023 crop year by 600,000 bales.

- World Use/demand for the 2022 crop year was lowered by over ½ million bales and World production raised over 400,000 bales.

- The US 2023 crop is estimated at 15.5 million bales—1 million bales higher than 2022.

- But exports for the 2023 crop year are projected at 13.5 million bales—900,000 bales more than 2022.

- World Use/demand for the 2023 crop year is projected to increase 6.6 million bales or 6% from 2022 crop year.

- While World production is expected to decline 670,000 bales.

–

This weeks export report was weak on new sales but shipments were fairly strong. For the past 4 weeks, shipments have averaged 401,000 bales per week. Shipments need to average only 283,600 bales per week to meet USDA’s increased projection of 12.6 million bales for the 2022 crop marketing year.

Uncertainty is high and anything can happen, but as mentioned, the market seems to be turning a bit more optimistic. These weekly exports will be used to validate or dismiss such optimism and price direction will hang on that and other news.

–

- Cotton Marketing News:Acreage Numbers are a Surprise – What Now? - July 11, 2025

- Gulf Coast Cattlemen’s Conference – August 8 - July 11, 2025

- Cotton Marketing News:USDA June Numbers—Neutral, Not Good but Not Bad - June 20, 2025