Don Shurley, UGA Professor Emeritus of Cotton Economics

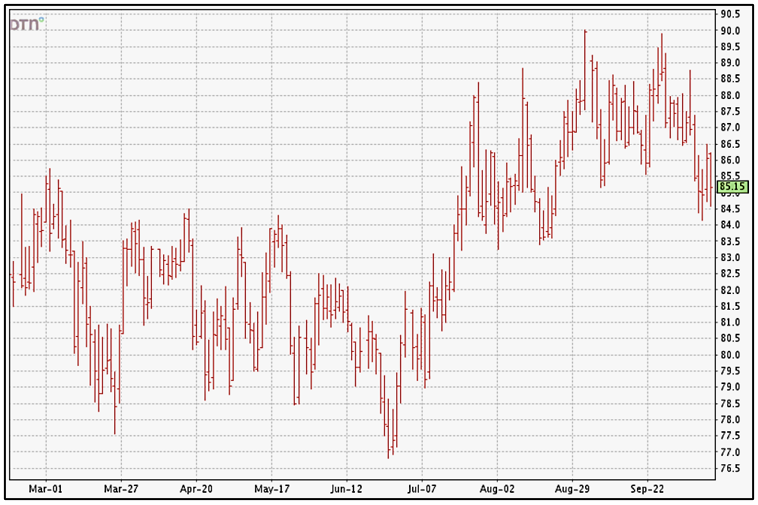

Prices (December futures) have taken a tumble in the past two weeks. The attempts at 89 to 90 cents have been met with pressures to move lower. Not all hope is lost, but for the grower, depending on how much you already have priced and at what price, it may cause us to pause and re-evaluate the outlook and decisions.

–

Should the pressure lower continue, there likely is still support at 83 to 84 cents. For the grower looking for 90, I know that’s not much consolation. We seem to be back in the mostly 84 to 89 price range but right now, the lower half of that is in play. Be patient for another run but the outlook is cautious.

USDA’s October supply/demand and crop production numbers, I’d say were neutral—seeming neither bullish nor bearish. The changes were mostly minor except for some statistical accounting changes in Brazil data—the impact of which is yet TBD. In summary:

- The expected 2023 US crop was reduced 310,000 bales.

- There were no changes in acreage planted or harvested but US average yield was reduced 19 lbs/acre. Forecast yields were lowered for Texas, Arizona, and Missouri.

- Exports for the 2023 crop market year were cut 100,000 bales.

- There was a large decline in 2023 crop year carry-in or Beginning Stocks. This was due to revisions in historical data for Brazil.

- Expected World production was raised slightly; Use/demand was lowered just slightly.

- There were no changes in China from the September estimates.

About the big changes to the Brazil data, in simplest terms, the changes were to

- Account for changes/shifts that have happened over time in the location and timing of Brazil’s cotton production

- To make USDA and Brazil statistical/data reporting more consistent across marketing years (southern hemisphere vs northern hemisphere).

There has been no change in the “physicality” of Brazil cotton—no bales have been added or subtracted—just statistical accounting changes/shifts in when (in what year) production and other data is reported.

It is yet unknown what, if any, impact this will have on the market. If anything, it seems that it might change our perception of Brazil in the global cotton picture—but again, nothing has been added or subtracted. So, only time will tell.

It’s very early. The US crop is again reduced and there is still uncertainty about the foreign crop. But there are also lingering concerns about global demand, US exports, and our price competitiveness. It is mostly these concerns and worries on the demand side that now hold prices back.

–

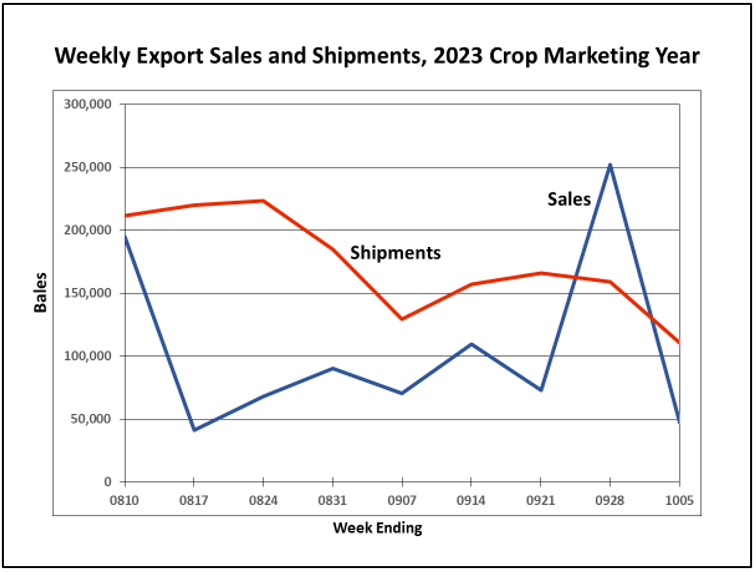

Again, it’s very early. Export shipments must average roughly 235,000 bales per week to meet USDA’s current forecast for the 2023 crop marketing year. In the most recent data, shipments have declined for 2 consecutive weeks with last week’s report being the lowest yet. Very strong sales reported 2 weeks ago were followed by very poor sales in last week’s report.

–