Don Shurley, UGA Professor Emeritus of Cotton Economics

A friend posted on Facebook (11/08/2023) about the horrendous decline in cotton price to 75 cents. Here was my response:

“When it gets bad and drops like this, it’s usually because the market is afraid and over-correcting. Yes, it hurts. But nothing to do but wait it out and hope for the negative market sentiment to fade. Right now, this is all on demand fears/woes and possible loss of market share to Brazil. Bad timing. I think most producers are up to 1/2 priced at 85 to 90 cents, so this helps. I hope the market will rebound to that level again but it will be a challenge maybe for a while yet.”

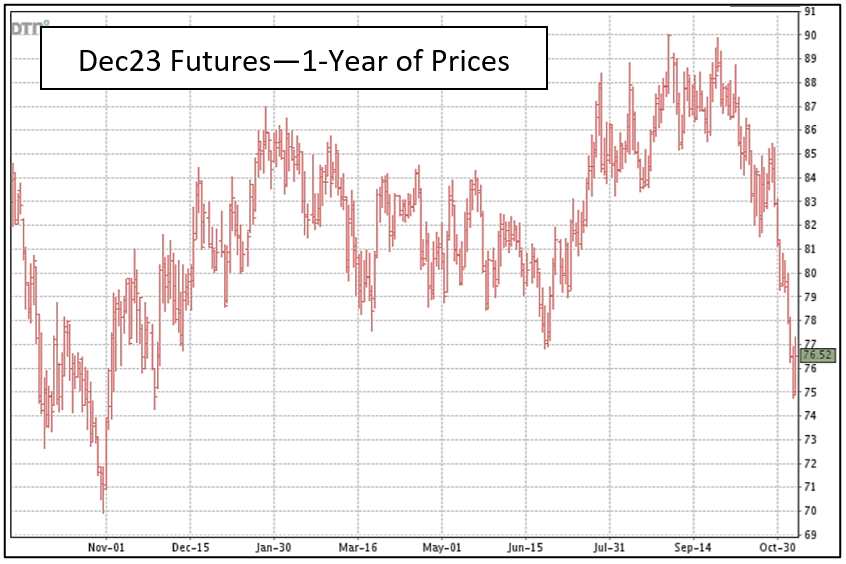

Prices (December 23 futures) now stand in the 75-76 cents area. Price has dropped 10 cents in just the last 2 weeks (8 trading days) and 15 cents over the last month. In the 75 cents neighborhood, we’re at the lowest level since November 2022. Reports suggest that this weakness is due to concerns over demand and U.S. exports.

Today’s USDA monthly crop production and supply/demand numbers for November were mostly neutral to bearish—but December 23 closed up for the day—a welcome sight after what has been mostly a string of consecutive downers. In summary:

- The projected US crop was raised 230,000 bales. Yield was increased. No change in acres. I believe an increase was a surprise, as most thought the crop would continue to decline.

- Projected US exports for the 2023 crop year were unchanged from last month’s estimate. This was a good surprise but USDA could post a reduction later.

- World production was raised less than 1 million bales, but no changes to China, India, Brazil, and Australia.

- No changes in exports for Australia, India, and Brazil.

- Imports by China were raised ½ million bales. Slight reductions for Thailand and Vietnam.

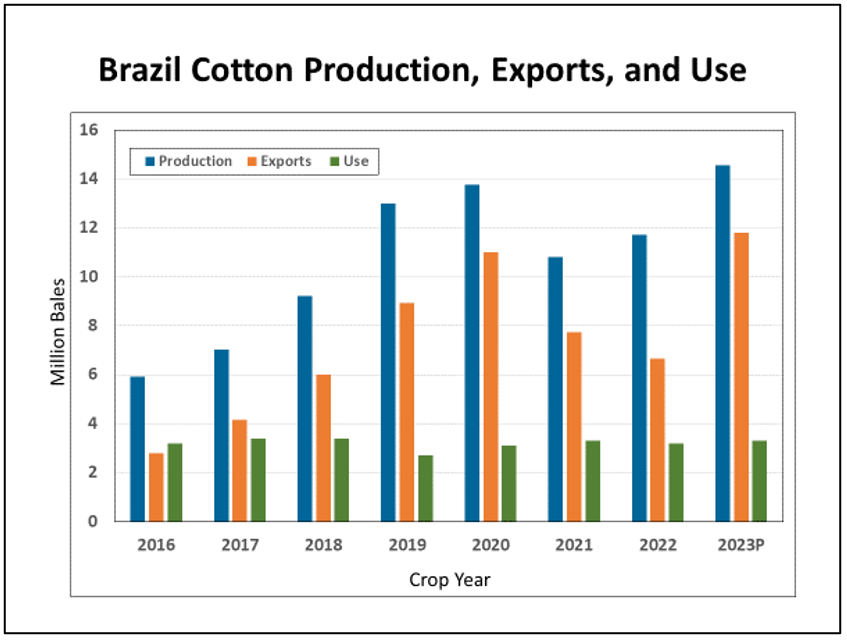

There has been quite a bit reported and written lately concerning Brazil—how it has become increasing competition for US export market share. Much of the weakness in price we’ve seen develop over the past month has been due to increasing concerns (fear and uncertainty) about demand and US exports, and Brazil has been somewhere in the conversation.

Brazil exports about 70% of production. When production increases, exports tend to increase. The 2023 crop is projected to be 24% larger than last year and a record crop. Exports are projected to increase by 77%.

These lower prices will dry up producer selling and hopefully also uncover better demand. If demand fears subside, supported and validated by good export sales and shipments, prices should start to improve. But it could be a slow process and we likely may not get back to the 87 to 90 cents area where producers want it to be.

Quick erosion in prices like this does a lot of damage, and there will be hurdles on the way back up that have to be negotiated.

–