Don Shurley, UGA Professor Emeritus of Cotton Economics

Shorter supply but uncertain and inconsistent demand/buying have been the factors driving price so far, this 2023 crop marketing season. Last week’s USDA February supply/demand projections should be favorable and supportive of the recent price uptrend. Below is a summary of the major items from the February report.

Both old crop (March 24 futures) and new crop (December 24 futures) prices have been on an impressive rally. Both the length and strength of the rally have been surprising. Old crop is now over 90 cents and new crop over 83. Old crop is up 14% and new crop up 8% from the lows set back in December and January. So, the run-up has been more substantial in old crop than new crop.

Is this rally “real?” It’s hard to argue with what we see. A bullish sentiment has certainly taken over. I can only best comment in terms of “good old supply and demand” that will ultimately rule—but other factors can and do come into play in the shorter term. It has been reported that this rally may be largely “speculatively driven”. I don’t doubt that, but some of the supply/demand signals are starting to look more positive.

Of particular note from USDA’s February report last week:

- US exports were raised; Brazil and Australia exports lowered.

- After many consecutive months of revisions lower, World demand/Use was increased slightly.

- China’s need for imports was raised ½ million bales and this matched by an equal ½ million bales increase in Use.

The 2023 US crop was unchanged from the January estimate but there seems to be growing belief that the US crop is going to eventually get smaller in future reports.

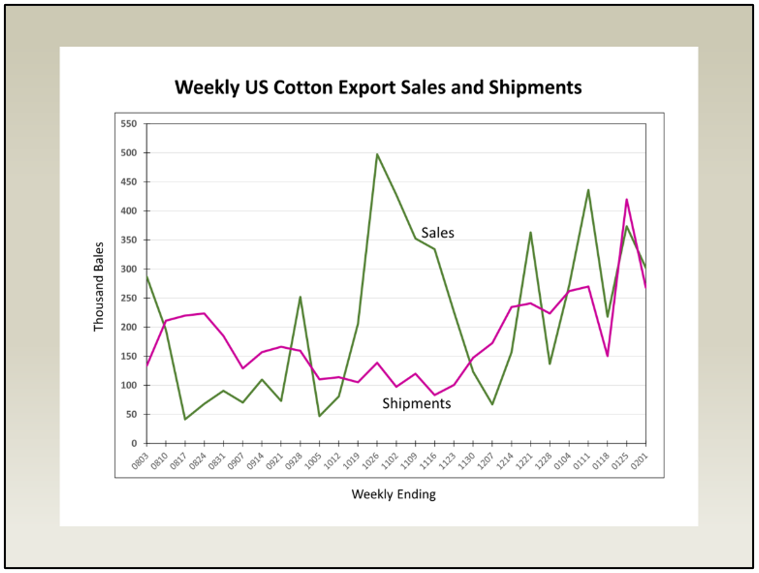

Export sales and shipments have been “inconsistently good”. As always, there have been good weeks and not-so-good weeks but the trend over the past 10 weeks has clearly been up. And as previously noted, USDA’s February report revised US exports up 200,000 bales from the January estimate.

If we expect higher prices to continue and not fall out of bed, demand/buying needs to show up at these higher prices and exports need to validate this demand.

The National Cotton Council will release their survey-based 2024 planting estimate this weekend. USDA will release its first showing of acreage estimates on Thursday, Feb15 this week during the annual Outlook Forum. Then, the USDA estimate of survey-based planting intentions will be released March 31.

Early acreage estimates this year are a tough call. Acreage is expected to remain stable or slightly higher than last year thanks to this latest rally. But Dec-24 futures is still below cost of production for many growers and less than what they would like to see. NOTE: The next newsletter will look at these acreage numbers and compare cotton prices and cost to other crops.

Could an increase in acreage be enough to scare the bulls and dampen prices? It also depends on how demand is doing.

–

- Cotton Marketing News:Acreage Numbers are a Surprise – What Now? - July 11, 2025

- Gulf Coast Cattlemen’s Conference – August 8 - July 11, 2025

- Cotton Marketing News:USDA June Numbers—Neutral, Not Good but Not Bad - June 20, 2025