The 2024 cotton outlook has improved recently. The key question is, “Was this price increase based solely on futures market speculation or will this price rally be maintained?” Credit: Doug Mayo, UF/IFAS

Don Shurley, UGA Professor Emeritus of Cotton Economics

Summary of the presentation provided at the Wiregrass Cotton Expo, February 9, 2024 — Dothan, Alabama

Market Update and Outlook

Sometimes crop prices can tug on each other’s coat tails. What happens to one can happen to others. But currently, and frankly surprisingly, cotton is the shining star as prices have recently found some steam when other crop prices have faltered. Prices (March 24 futures) have broken out of the 3-month long mostly 79 to 83¢ range and have advanced to the 87 to 88¢ area. New crop price (December 24 futures) is around 82¢.

Reports and commentary seem to suggest that this run is mostly “speculator driven”—speculative buying at lower prices acts to fuel optimism and push prices higher. The question is, and whether or not this rally can be sustained depends on, will there be actual mill demand/buying at these higher prices? If this rally is mostly speculatively driven, and what I read seems to suggest it is, when speculative buyers start to sell and take their profit, prices will drop.

The most recent weekly export report was very positive. This likely fueled some of the resurgence in price but there is still much uncertainty about demand. Export numbers will need to remain good to justify and sustain this increase in prices. The supply side has also given fuel to this latest price rally. USDA’s January supply/demand report trimmed the US crop 350,000 bales and could be reduced further.

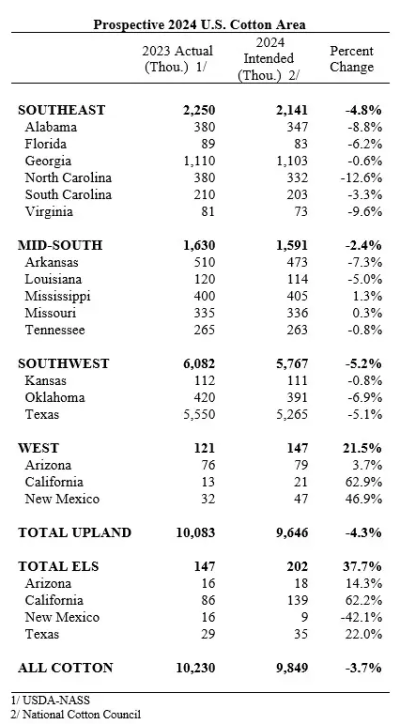

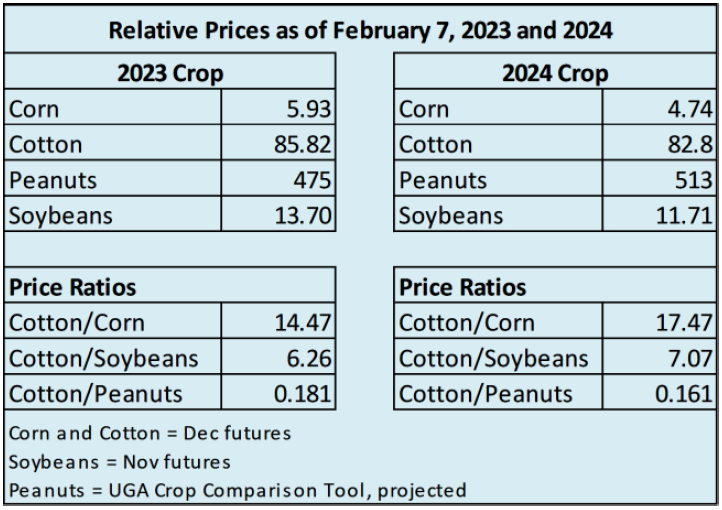

The National Cotton Council released its survey-based 2024 acres planted estimate on February 18 (table to left). The first USDA estimate will be released March 31. Does the current price rally render the NCC estimate less useful? Will the current higher price level still exist into March? Currently, using relative price ratios, compared to last year this time, cotton price has gained relative to corn and soybeans but declined relative to peanuts.

Current price ratios might suggest an increase or at least stable cotton acreage for 2024. The Projected Price on crop insurance for cotton is currently $0.81. This could increase but currently is not as attractive as the $0.85 for the 2023 crop.

The 81¢ on crop insurance and the 82-83¢ level on December 24 futures is likely below the breakeven price needed for many producers, unless above average yield is achieved. For that reason, producers may be reluctant to price any of the expected 2024 crop at current prices.

–

Farm Bill Update

The 2018 farm bill (effective for the 2019-2023 crop years) expired on September 30, 2023. Congress provided a 1-year extension of the 2018 bill until September 30, 2024.

Of most interest to farmers, the ARC/PLC and crop insurance portions of the safety net are of major concern and have been the source of much debate prior to the extension and will continue to be until a new farm bill gets done. With ongoing other business also on Congress’ slate and with elections coming up in November, it is not certain that another farm bill will get done. Another extension into 2025 is possible.

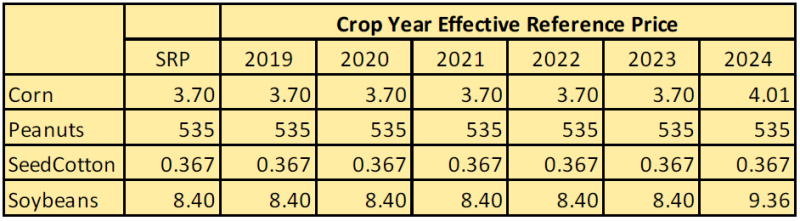

Farm and commodity organizations have called for increasing the Reference Prices used in PLC and ARC—arguing that these prices have not kept pace with higher costs of production. The 2018 farm bill did institute the Effective Reference Price concept in attempt to improve the safety net. But this has been ineffective and too slow to react. Effective Reference Prices are still far below the market and too low to be part of an effective safety net.

It has also been debated that loan rates need to be increased. The Loan program works as a temporary cash flow mechanism to assist while marketing the crop. Loan rates lag far behind increased cost of production.

The 2014 farm bill eliminated cotton as a covered commodity but established the STAX area revenue policy exclusively for cotton. Seed cotton was then added to the farm bill in 2018 and eligible for ARC/PLC. But, seed cotton base cannot be enrolled in ARC/PLC and the cotton acres planted on the same farm be eligible for STAX. There has been discussion about how to get ARC/PLC and area insurance policies to work better together or simply try to reduce the complexity in choices.

As always, finding funding for new spending will be a huge challenge. There is also opposition to redirecting funds from other sources to pay for farm bill commodity programs spending. I think the worst-case scenario is we keep the farm bill safety net as it is. At best, perhaps Congress working with commodity leaders will be able to make at least a few of the needed revisions.

–

Understanding Crop Insurance Options

The crop insurance sales closing date for cotton is February 28. Producers must also make the ARC/PLC election by March 15. Producer decisions on these 2 parts of the “safety net” are not mutually exclusive—the choice(s) you make on one impact the choice(s) you will have on the other.

The following is a summary of crop insurance (STAX and SCO) and ARC/PLC options.

- Both STAX and SCO are available for cotton.

- Cotton acres planted on a farm with seed cotton base, if that base is enrolled in ARC/PLC, are not eligible for STAX; but the base can be enrolled in PLC and crop covered by SCO.

- If cotton is planted on a farm with seed cotton base, but that base is not enrolled in ARC/PLC, acres planted may be covered by STAX or SCO.

- If a farm has no seed cotton base, cotton acres planted on that farm are eligible for both STAX or SCO.

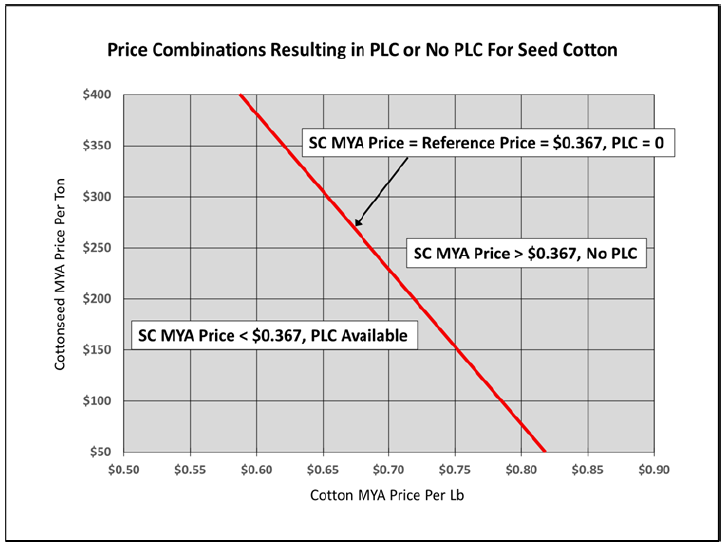

The Effective Reference Price for seed cotton remains at 36.7 cents per lb for 2024. A PLC payment is not expected.

- If there should be no PLC payment, producers may choose to forgo/not enroll in ARC/PLC and take STAX.

- If there is expected to be no PLC payment, producers could by default enroll in ARC just for the chance that it might pay off; but would then be ineligible for both STAX and SCO.

- If a producer wants the risk management benefit of both expanded crop insurance and possible ARC/PLC payment, the PLC+SCO combination would allow that.

–

Other considerations

- STAX does not require an underlying yield or revenue policy. STAX can be purchased alone. SCO can be yield or revenue and must have an underlying yield or revenue policy.

- Both STAX and SCO are area policies that cover “shallow losses”. STAX coverage starts at a maximum of 90% (has a 10% deductible). SCO coverage starts at 86%– has a 14% deductible. So, STAX can offer higher protection (90% vs 86% on an area basis) against shallow losses.

- STAX has higher premium subsidy than SCO. So, the STAX premium paid by the producer might be lower than with SCO.

- ECO (Enhanced Coverage Option) is another area “shallow loss” insurance plan. ECO starts at either 95% or 90% and covers down to 86%. You can enroll seed cotton base in ARC (so, wouldn’t be eligible for STAX on planted acres) but also take ECO. Acres not insured by STAX may be insured by ECO.

It comes down to how much risk you are comfortable taking. Producers might want to first decide how to adequately insure their own crop. Then think about how much and which area shallow loss program to add. Since any PLC payment is likely to be none or very small, it’s not likely worth sacrificing crop insurance coverage for.