Don Shurley, UGA Professor Emeritus of Cotton Economics

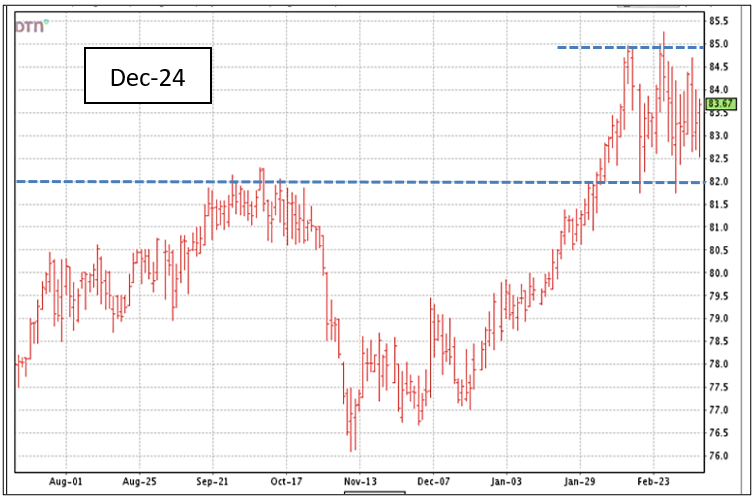

Old crop prices (May and July futures) have lost some luster but still stand around 95¢—down from the near $1.00 level of just a couple of weeks ago. So, old crop has given back about a nickel since the peak. New crop December 2024 futures seems to be happy zigzagging mostly in the area of 83 to 85¢.

The spread between old crop (May) and new crop (Dec) has declined (narrowed) by about 4 to 6¢—from almost 16¢ May over December, to now less than 12 cents. If this spread continues to narrow, that means old crop declines in relation to new crop and/or new crop increases in relation to old crop.

Old crop futures prices seem to face resistance at that $1.00 level and have support at the 90 to 95 cent level. Most producers I’ve had conversations with have little or none of the 2023 crop left to sell anyway. Those that do, say they face a very wide basis or no offers at all. Demand/mill buying is weak/dismal.

For now, new crop futures prices seem to have settled in the 82-83 to 85¢ area. I believe this range is fairly well entrenched until demand shows more strength and until more is known about 2024 acreage and potential production. This may not be an attractive enough price to entice much in the way of contracting at this early date. But “something with a 9 in the front” doesn’t seem likely yet until supply/demand conditions get more positive.

Last week’s USDA monthly supply/demand numbers for March were, in fact, positive and supportive. A summary of main points:

- The 2023 US crop was reduced 330,000 bales.

- Exports for the 2023 crop marketing year ending July 31 were unchanged from the February projection.

- World Use/demand for the 2023 crop year was increased 480,000 bales. This is the 2nd consecutive month that Use has been revised upward.

- Exports from Brazil were unchanged but increased for Australia and Turkey.

- Use was increased ½ million bales for China and imports were raised 900,000 bales.

These are supportive numbers. The market awaits solid economic evidence to validate higher prices rather than speculative actions. In recent weeks, export shipments have been “decent”, but sales have been poor.

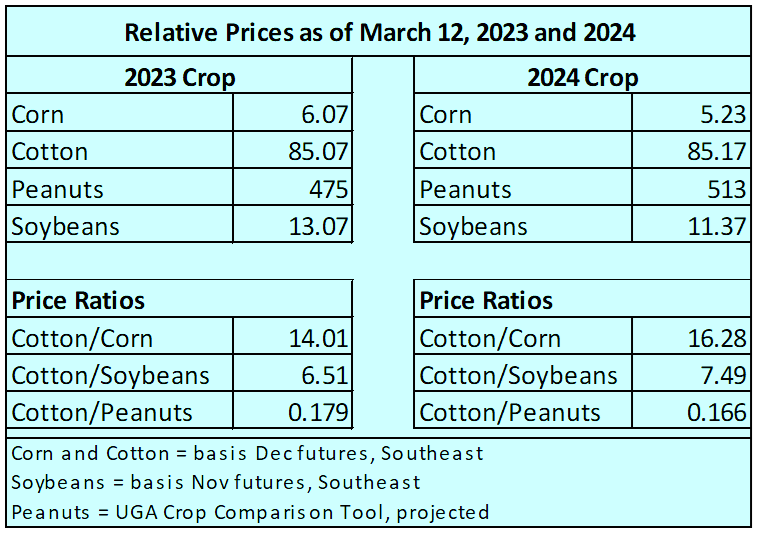

On March 31, USDA will release its first survey-based “statistical” projection of acres to be planted this year. Given the run in cotton prices over the past 2 months, while prices for competing crops have faltered, I believe it’s generally expected now that cotton acres will increase at least slightly this year.

Can the higher prices we’re seeing coexist with an increase in acres and production? Even though 85-cent cotton excites no one, current price ratios compared to this time last year show that cotton has gained in price relative to corn and soybeans. Cotton price is less relative to peanuts. What farmers will do this year is highly uncertain? It’s hard to plant something, anything, knowing price and income are at risk especially when considering costs.

–