Don Shurley, UGA Professor Emeritus of Cotton Economics

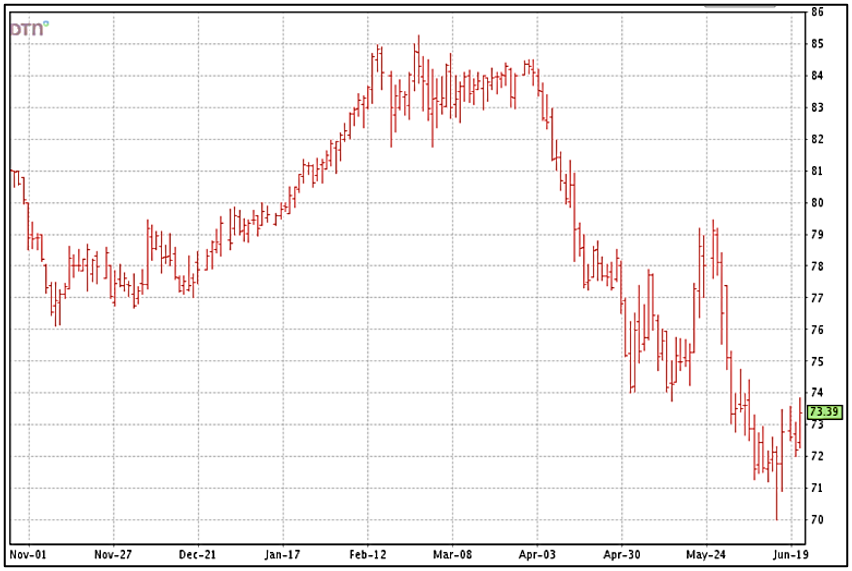

Prices (December 24 futures) are attempting a rally. Since the string of closing prices below 72¢, price has gained roughly 2¢ and is now testing what could be a little resistance at the 74¢ area.

If we can successfully negotiate the possible hurdle at 74, this could set the market’s eye on 77 to 78 next. But, let’s not get too bullish too early. One step at a time. This “mini-resurgence” is thought to be due to speculative buying, some actual buying at low-price 72 cents, and increasing weather concerns.

This month’s USDA supply/demand report was neutral and has been pretty much a non-factor.

- US exports for the 2023 crop marketing year that ends July 31 were reduced ½ million bales from 12.3 to 11.8 million bales. This raises stocks that we’ll carry into the 2024 crop year.

- Projected World use for the 2024 crop year was raised slightly from the May estimate; China was unchanged; Vietnam was increased 100,000 bales.

- Projected 2024 crop year exports were lowered for India, increased for Australia.

- The USDA projection for the 2024 crop US average farmer price was lowered from 74.0 cents to 70.0 cents.

With the revision down in US exports for the 2023 crop marketing year, Brazil surpassed the US as the World’s largest cotton exporter. For the upcoming 2024 crop year, USDA is projecting 13.0 million bales export for the US vs 12.5 million bales for Brazil.

Weather is increasingly becoming a factor in production and in the market. We are entering a critical juncture in the crop’s early development. Very high temperatures combined with the lack of rainfall is putting stress on a fairly significant portion of the crop.

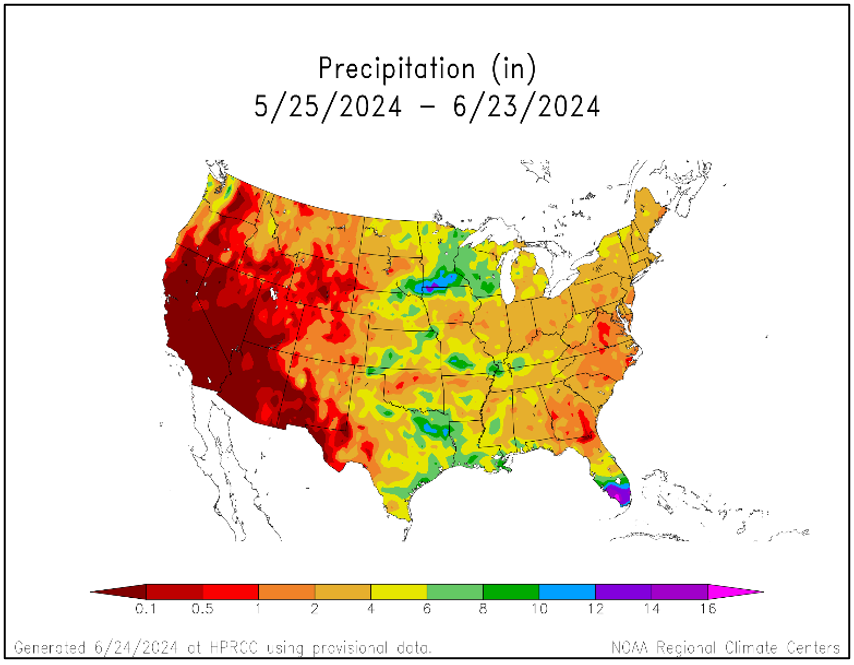

The USDM (Drought Monitor) map does not appear to adequately capture the situation. More telling, the following is a map of precipitation over the past 30 days.

Many areas of the Southeast have had less than 2 inches of rain and some 1 inch or less over the period. Some areas of west and central Texas likewise have had little rain. Speaking only of the situation here in Georgia, we need rain badly. Yes, about ½ of both our cotton and peanut crops are irrigated but that also means ½ isn’t. Even with irrigation, systems cannot keep up under high temperatures with so little rainfall.

As of June 23rd, 14% of the US crop was rated very poor to poor; 56% was rated good to excellent. The Texas crop was 19% very poor to poor and 10% of the Georgia crop likewise.

USDA’s first statistical estimate of 2024 actual acres planted will be released Friday, June 28. Due to price ups and downs (mostly down) since the March plantings intentions, this weeks number is highly unknown and much anticipated. In March, farmers said they intended to plant 10.67 million acres—4% more than last year. But price (Dec24 futures) was 82 to 84 cents then and declined 12% thereafter. Most pre-report projections I’ve seen think acreage will remain near the March number—a little lower to slightly higher.

–