Don Shurley, UGA Emeritus Cotton Economist

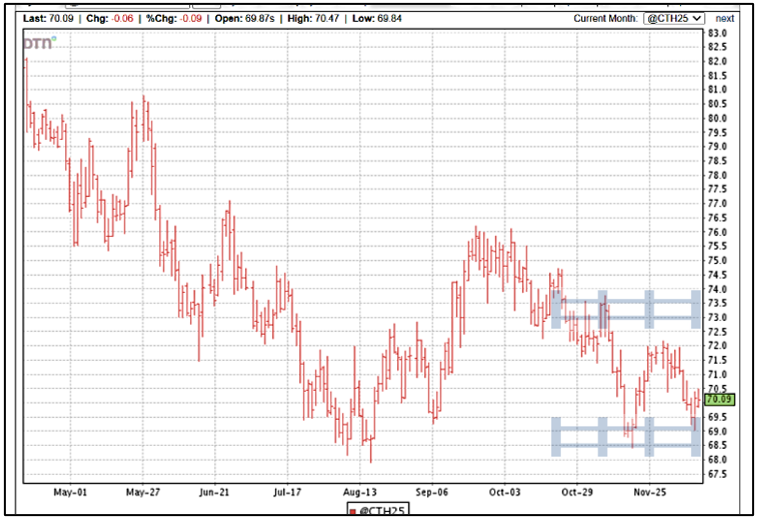

Cotton prices continue to struggle. Every attempt to gain some ground is met with headwind or negative news/forces leading prices to retreat.

There are two “fences” in this market—one at 72 to 73 cents (the front fence) and the other at 69 cents (the back fence).

For producers with an uncommitted, unpriced crop, what should you do? Eventually, the crop must be sold. Yet we’re staring at a market that seems is not willing to move up. And we’ll eventually need cash flow, if not already. So, what to do?

You could 1) put the crop in Loan, or 2) take a deferred price or “on call” or “provisional” contract, or 3) sell the crop and purchase a Call Option. Each of these will provide cash flow now but delay selling until later. Of course, in each case you’re risking the price could go down while you wait and hope it goes up. The Call Option is probably the safest way to play this, but there are no zero-risk ways to do it.

USDA’s December supply/demand numbers came out earlier this week on Dec 12th. Here’s a quick summary:

- The 2024 US crop was increased slightly due to a slight increase in expected US average yield.

- Exports for the 2023 crop marketing year are projected at 11.3 million bales—unchanged from the November estimate.

- World Use/demand was raised 570,000 bales from the November projection. Use was lowered ½ million bales for China with notable increases for India, Pakistan, and Vietnam.

- With the drop in projected Use, imports were also lowered ½ million bales for China.

- Exports were raised 200,000 bales for Brazil. Brazil is now the World’s leading exporter—surpassing the U.S.

New crop December 2025 futures are currently at roughly 72 cents. This is “within the fence” of where old crop March 2025 is now. This is also well below where December 2024 was last year at this time, and for the entirety of the time prior to planting the 2024 crop.

So, this is the question—how will farmers respond with their 2025 planting decisions? There’s certainly no profit to be made with 72-cent cotton. And, here’s the larger question—if farmers cut back on cotton acres, will that be reason enough that prices would/should respond (to get back to the 80’s)? 72-cent cotton sure seems to be signaling that the World doesn’t want/need as much U.S. cotton.

And yet, there is plenty of evidence to suggest that U.S. growers are going to plant cotton (or at least a fairly significant amount) regardless of price. This is because 1) in some areas there are few if any agronomically feasible alternatives, 2) crop rotation requirements and constraints, 3) lack of more profitable alternatives, and 4) growers are also owners and invested in infrastructure like gins, etc.

Price is not the only consideration. All prices have trended down in a similar pattern this year, but price ratios during the 2024 crop growing season show that cotton lost relative position (the ratio increased) compared to corn and soybeans—corn more so than beans. Current price ratios for the 2025 crop show cotton in pretty much the same relative position as for the 2024 crop.

With demand being weak and uncertain, cotton price responds to weekly export sales and shipments. As of the latest report (for the week ending December 5th), shipments for the 2024 crop marketing year total 2.49 million bales. Sales over the last six weeks have averaged 239,600 bales per week. Shipments have averaged 149,500 bales per week.

To reach USDA’s projection of 11.3 million bales for the marketing year ending July 31, shipments must average roughly 259,000 bales per week for the remainder of the marketing year. We are well below that pace. Unless sales and shipments pick up, USDA may lower the exports projection further in its future monthly estimates. This would add to bearish sentiment in the market, presenting more challenge for prices. On the other hand, good weekly export numbers will provide opportunity for better prices.