Don Shurley, UGA Emeritus Cotton Economist

Don Shurley, UGA Emeritus Cotton Economist

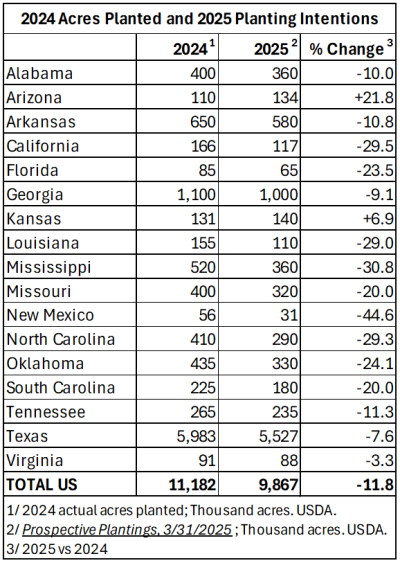

Farmers say they intend to plant 9.87 million acres of cotton this year—down 11.8% from last year. This is based on a survey of producers conducted by USDA during the first two weeks of March. These estimates reflect farmer “intentions” as of the survey period.

These 9.87 million acres compare to 9.56 million acres estimated by the National Cotton Council (NCC) in February, and 10.0 million acres projected in the USDA Outlook Forum also later in February. Most industry observers were expecting a reduction in acres planted of 12 to 15% or more. So, 9.87 million is within most expectations but the reduction is on the lower side.

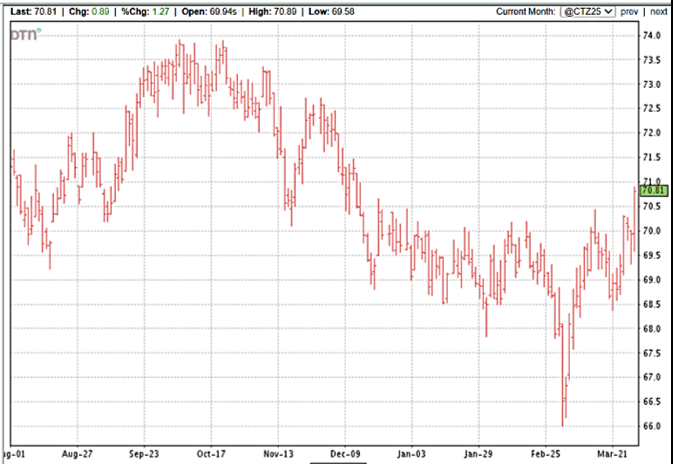

Prices (new crop December 2025 futures) have jumped to near 71 cents. Price did not react Monday on the released numbers but seemed to have a “delayed” rally Tuesday. The 9.87 million acres number cannot be considered a surprisingly low number, as it’s higher than the already known NCC estimate and close to the Outlook Forum number. So, it’s hard to gauge whether or not 9.87 million acres is really a factor at this point.

The first USDA estimate of actual acres planted will not be out until June 30th. Until then, we’ll go with the 9.87 number and begin to factor in weather and crop conditions. This 9.87 “intentions” is subject to change due to prices, costs, and weather.

The latest export report (for the week ending March 20) showed weak sales of only 107,500 bales but very good shipments at 417,400 bales. Demand is still the main driver to better prices. The U.S. supply side will be more firmed up in time. In the meantime, good exports are crucial. Uncertainties and the impacts of the tariff situation will also come into play.

–

- Cotton Marketing News:Acreage Numbers are a Surprise – What Now? - July 11, 2025

- Gulf Coast Cattlemen’s Conference – August 8 - July 11, 2025

- Cotton Marketing News:USDA June Numbers—Neutral, Not Good but Not Bad - June 20, 2025