Don Shurley, UGA Emeritus Cotton Economist

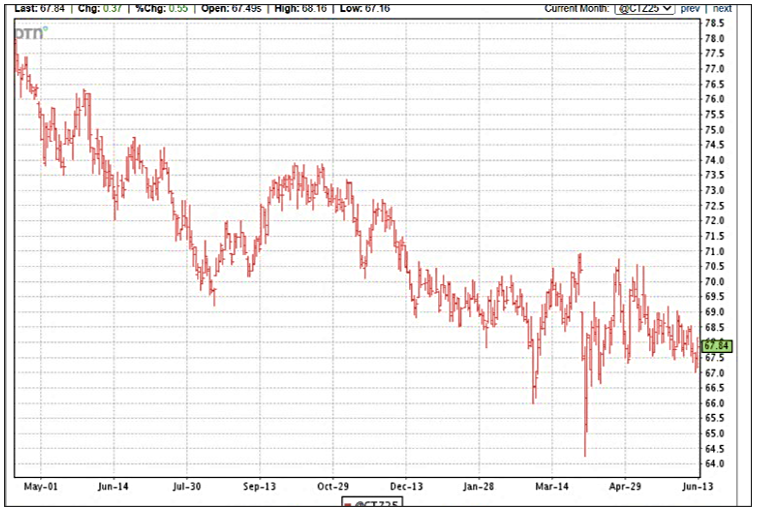

Last week’s USDA monthly supply/demand estimates for June do not contain enough good news to support higher prices. But also, there’s not enough negative news to call for price to move lower. So, prices (December 2025 futures) are likely to remain mostly in the 67 to 71 ¢ range as they have for the past 6 months.

The Good

- US exports projected for the 2024 crop marketing year ending July 31 were raised 400,000 bales to 11.5 million bales.

– - World production for the 2024 crop was lowered 1.14 million bales; accounted for mostly by India (lowered 1 million bales).

– - World production for the 2025 crop was reduced 820,000 bales from the May estimate: accounted for by reductions for the US, India, and Pakistan.

– - US exports for the 2025 crop year remain at 12.5 million bales – unchanged from May. If realized, this is a 1 million bale increase from the 2024 crop year.

–

The Bad

- Production for China for 2025 was raised 100,000 bales from the May estimate; 2025 crop year imports for China were lowered 50,000 bales.

– - World Demand/Use for the 2025 crop year was lowered 320,000 bales from the May estimate: accounted for by reductions for India, Turkey, and Bangladesh.

–

Now, a big unknown in all this is, “What impact does the US crop have on the market?” The U.S. is now the 4th largest producer, 4+ million bales behind Brazil. We are roughly 2 million bales behind Brazil in exports. How much of a “mover” is the U.S. in determining World and US price movement and price direction? Maybe all we can conclude is that the U.S. role is still important but has been diminished.

It’s early, but in USDA’s June numbers, the US crop is projected at 14.0 million bales. That’s ½ million bales less than the May estimate. Harvested acres and expected yield were both revised down.

In the USDA March Prospective Plantings report, farmers said they intended to plant 9.87 million acres this year—down 12% from last year. I believe that number could end up being too high and closer to 9.5 million or even less. It seems possible that continued low cotton price since March may have dampened intentions.

If acreage declines further, it remains unknown as to whether or not that matters enough to push prices to the next tier of 72 to 75 ¢. The first estimate of actual acres planted will be the USDA Acreage report on June 30.

–

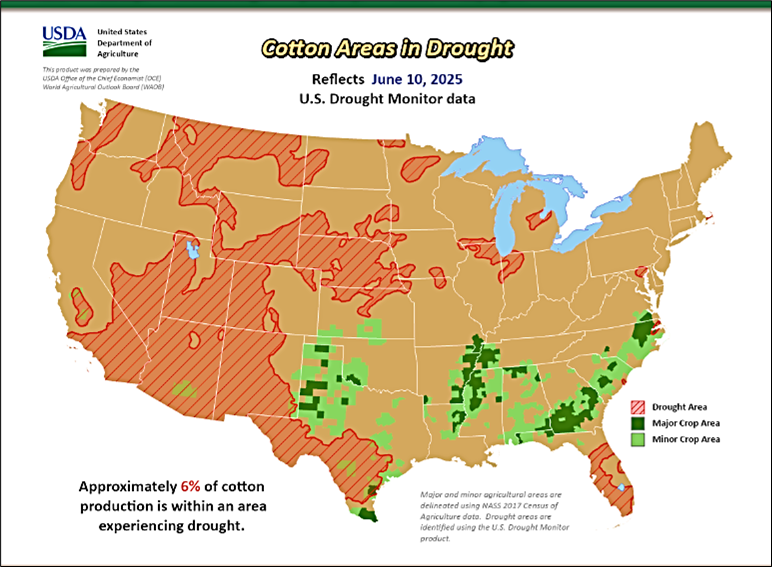

Thus far, prices have not been responsive to less U.S. acres, because growing conditions and planting progress have been mostly good. According to the map above, only 6% of cotton production is currently within a drought area.

As of June 8, 21% of the crop was in poor or very poor condition and 49% good or excellent. Texas was 31% poor or very poor, Tennessee 32%, and North Carolina 22%. As of June 8, the crop was 79% planted compared to 80% normal.

–