Kenny Burdine, Livestock Economist, University of Kentucky

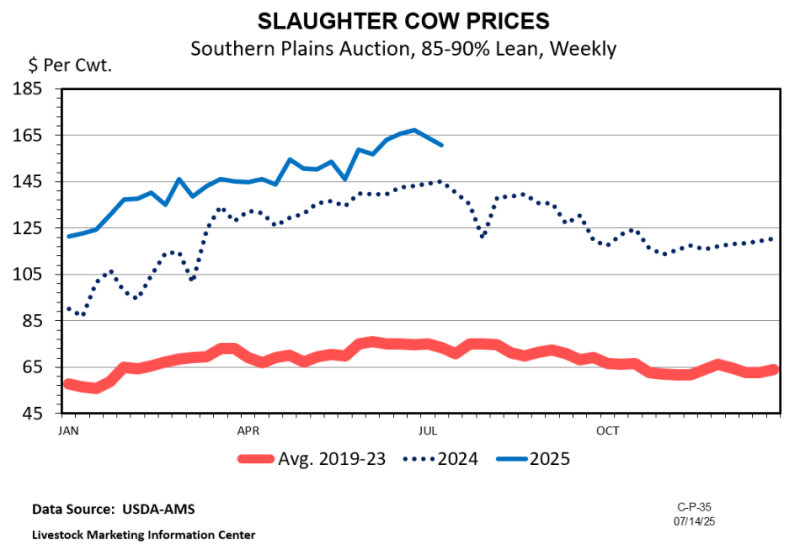

Cattle markets have been impressive across the board in 2025, and cull cow markets have been no exception. The monthly average price for 80-85% average dress boning cows in Kentucky set a record in June and may set a new record in July. June 2025 prices were 16% higher than June of 2024 and 62% higher than June of 2023. This is a trend across all regions of the US as demand remains strong and cull cow supplies remain tight. I want to briefly discuss some specific factors behind these prices levels.

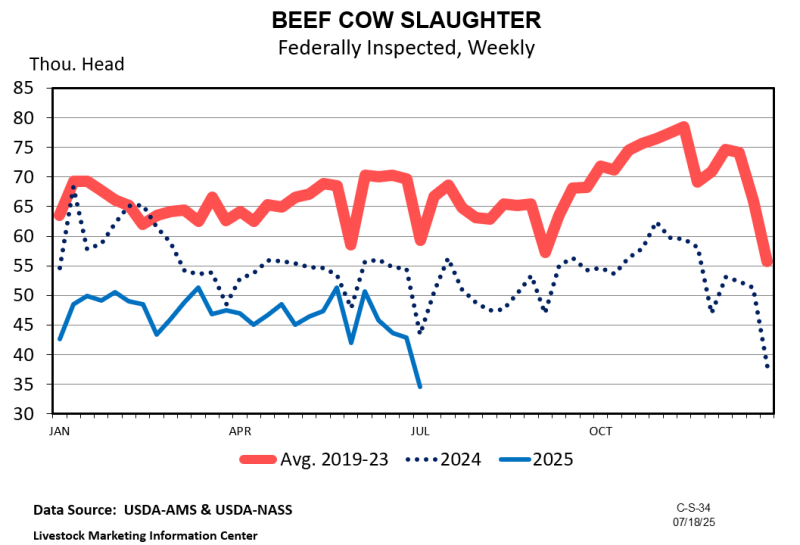

The most obvious reason for the extremely high cull cow prices has been sharp reductions in slaughter levels. As I write this in late July, beef cow slaughter is down 17% year-to-date from 2024. If this trend continued through the end of 2025, it would represent a reduction in beef cow slaughter of more than 450,000 cows. The beef cow herd was culled hard from 2021 to 2023, so it is likely that a lot of poor performers have already exited the herd. And of course, the current calf market is encouraging producers to hold on to cows a bit longer than usual. It is also worth pointing out that dairy cow slaughter is down 7% for the year, which is also contributing to the tight supplies.

–

Consumer demand has been strong and has probably been overshadowed a bit by discussion of tight supplies. Ground beef represents a significant share of beef consumption, and a large portion of cull cow slaughter is targeted for the ground beef market. It is also likely that high retail prices are pushing some consumers towards lower priced ground beef, as opposed to higher priced cuts. While supply is absolutely a major factor, strong demand has added fuel to the fire.

Finally, there is another element that has not gotten as much attention, but that I consider to be significant. Multiple dynamics have pushed cattle to higher slaughter weights over the last few years and that has led to a substantial increase in quality grades. For some perspective, 10.6% of cattle graded Prime in 2024 and that percentage is running at about 11.8% thus far in 2025. This increase in marbling also means there is an increase in the amount of fat in the trim, which creates additional demand for lean trim to be used for blending. Since cull cows are a source of lean trim, this has also contributed to strong cull cow markets.

- NBGC Model Farm Field Day will Showcase Innovative Row Crop Practices – September 12 - August 15, 2025

- 10 Reasons You Should Quit Making Hay - August 8, 2025

- Factors Driving Strong Cull Cow Markets - August 8, 2025