Kevin Athearn, Regional Specialized Extension Agent for Agribusiness, NFREC Suwanee Valley

This article describes recent price trends and market fundamentals for grain corn and peanuts.

–

Grain Corn

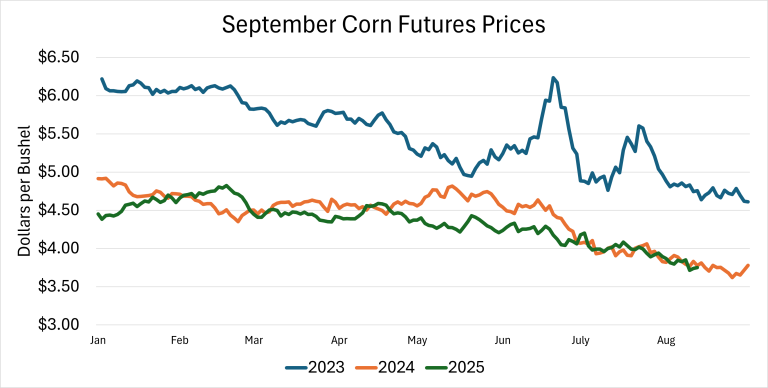

The local grain corn price for August delivery is typically determined by the Chicago Board of Trade September futures contract price plus the basis (additional amount) offered by local buyers. Figure 1 below shows the September futures price between January and August the past three years. In all three years, the price fell in late July and August, when most corn is harvested in North Florida. A review of historical data shows that the September futures price was lower in August than the January-July average in 16 out of the past 20 years.

Figure 1. Daily September futures prices for grain corn. Data source: Chicago Board of Trade and Barchart.com

–

Since January 1st, the highest September 2025 futures price of $4.83/bushel occurred on February 20th. Since then, the price has trended downward, closing at $3.75 on August 14th. Although the futures price has been low and getting lower, the local basis in North Florida has been relatively strong. Based on weekly quotes from three local buyers, the basis ranged from +$0.70 to + $0.90 per bushel in March through early July. In mid-July through early August, local basis bids ranged from $0.80 to $0.90 over September futures.

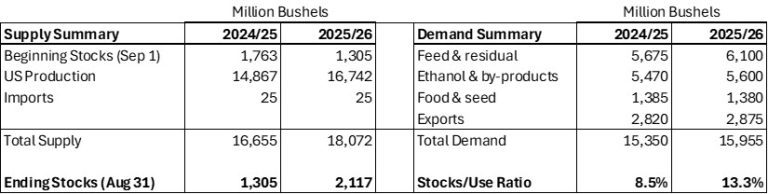

Although old crop (2024 harvest) corn stocks are relatively tight, projections of a record 2025 crop have been pulling prices down. The USDA has been projecting record corn production in the U.S. for the 2025/2026 marketing year, and their estimates were revised further upward in the August 12th World Agricultural Supply and Demand Estimates (WASDE) report. The planted area estimate increased 2.2% to 97.3 million acres, and the yield estimate increased 4.3% to 188.8 bushels per harvest acre. The projection for total US production in the 2025/2026 marketing year is 16.7 billion bushels (Figure 2). If that projection is accurate and demand does not increase proportionally, prices will likely remain depressed into 2026.

Figure 2. Supply and demand estimates for U.S. grain corn. Data source: USDA World Agricultural Supply and Demand Estimates (WASDE).

–

Peanuts

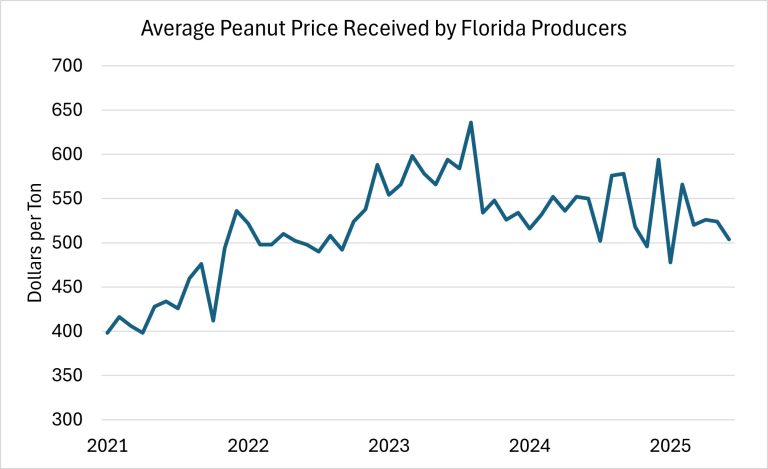

Figure 3 below shows the average monthly price received by Florida producers since 2021. Although prices are currently higher than they were in 2021 and 2022, they have declined since 2023. The six-month, January to June 2025, average price received by Florida producers for stored peanuts was $520.

Figure 3. Average monthly peanut price received by Florida producers. Data source: USDA National Agricultural Statistics Service (NASS).

–

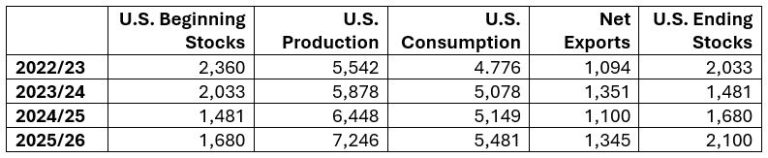

Peanut stocks have been relatively tight since 2023, supporting moderately high peanut prices. However, U.S. peanut acreage has increased every year since 2022. The current USDA forecast for 2025 production is 7.2 billion pounds. If realized, that would be a U.S. record, slightly above the 2017 crop, which came in at 7.1 billion pounds.

Figure 4. U.S. peanut supply and disappearance (millions of pounds). 2024/25 data are estimates, and 2025/26 data are forecast. Adapted from USDA Economic Research Service, Oil Crop Outlook, August 2025.

–

With expectations of a large crop, peanut shellers have not been offering contracts except very briefly last winter (personal communication with buying points). Peanut growers are preparing to harvest peanuts with little, if any, of their peanuts already priced. Given the size of the 2025 crop, the price outlook is bearish.

USDA Marketing Assistance Loans, Loan Deficiency Payments, Price Loss Coverage (PLC), and Agricultural Risk Coverage (ARC) programs provide a safety net for eligible peanut producers. The current loan rate is about $354 per ton for average quality runner type peanuts, and the 2025 reference price is now $630 per ton.

–

Acknowledgments

Amanda Phillips, UF/IFAS data management analyst, obtained the weekly basis quotes referenced in this article.

- Surprise!January WASDE Report Moves Corn and Soybeans Lower – Cotton Flat - January 16, 2026

- Don’t Ignore Cow Size When Comparing Calf Weaning Weights - January 9, 2026

- Federal Estate Tax and Gift Tax Limits Announced For 2026 - December 19, 2025