Don Shurley, UGA Emeritus Cotton Economist

USDA’s August crop production and supply/demand estimates for the 2025 crop should really have not been a shocker—but they apparently were to some. U.S. acreage and estimated production were reduced sharply from the July estimates. Prices have not been pushed higher by the numbers (not yet) but a smaller U.S. crop could nevertheless be the beginning of an improved outlook. But, this may take more time. These numbers will continue to be revised.

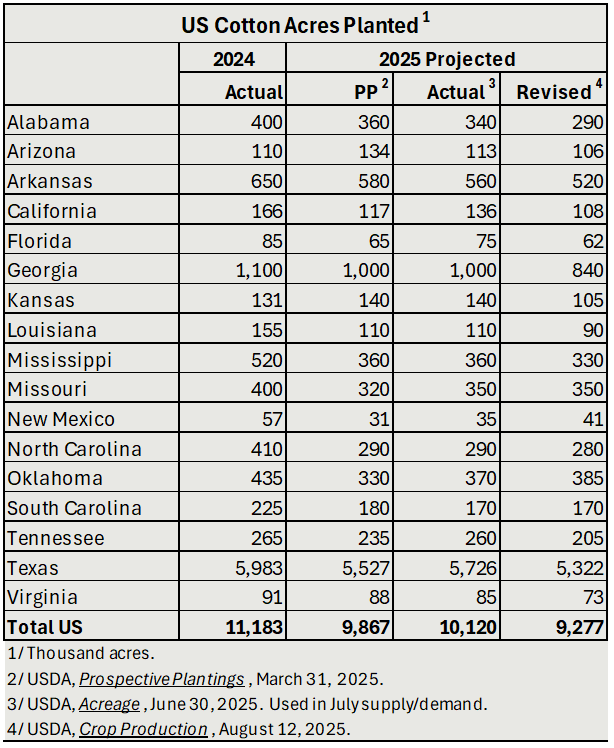

Acres planted were reduced 843,000 acres from the June USDA Acreage report projection. More significantly, acreage abandonment was increased and acres expected to be harvested were cut 1.3 million acres. Projected abandonment was increased from 14% of acres planted to 21%.

Acres planted were reduced 843,000 acres from the June USDA Acreage report projection. More significantly, acreage abandonment was increased and acres expected to be harvested were cut 1.3 million acres. Projected abandonment was increased from 14% of acres planted to 21%.

Of the 843,000-acre decline in projected acres planted, 600,000 of it (71%) is accounted for by Texas (440,000 acres lower) and Georgia (160,000 acres lower). Compared to the June report, acreage was reduced in almost every state. I haven’t researched it, but I would think this would be very unusual. The 2025 US crop is now projected at 13.21 million bales—1.3 million bales less than last month’s July estimate and 1.2 million bales below last year.

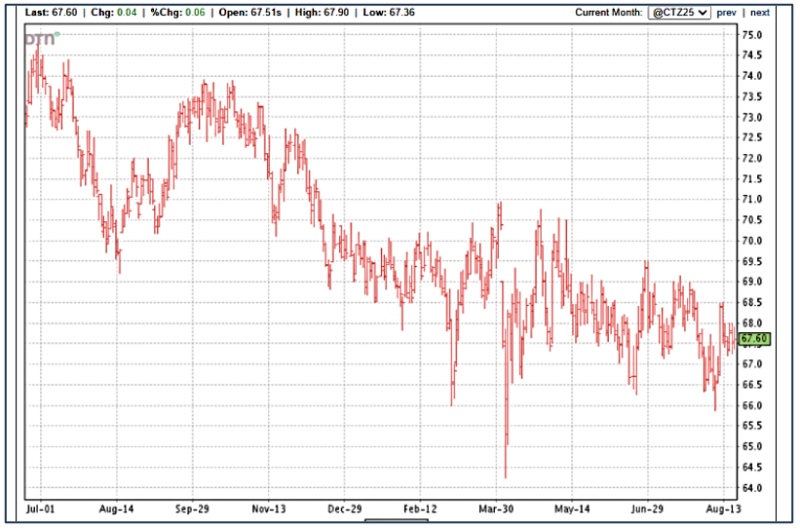

Prices (December futures) initially rallied over 68¢ on the report of a sharply lower US crop. But, any increase has yet to be sustained. Dec futures remain in the mostly 67 to 70¢ area. So, although acreage and production are down from earlier projections, it appears the market will wait and play out based on crop conditions and demand.

Here are some important highlights elsewhere in the August USDA supply/demand report—some of it good but some of it acting to offset somewhat the lower US crop estimate.

-

US exports for the 2025 crop marketing year were lowered ½ million bales from the July estimate. This could simply be due to the lower available U.S. crop.

– -

China’s Use was raised 1 million bales, but production was also increased (1/2 million bales).

– -

World Use was lowered slightly from the July estimate. Reductions were for India, Turkey, and Bangladesh.

–

Weekly export sales were 251,000 bales in the most recent report. Sales thus far (including during the 2024 marketing year) are 3.32 million bales. Shipments were 159,000 bales. Shipments need to average roughly 231,000 bales per week to meet USDA’s projection for the 2025 crop marketing year. Of the 3.32 million in sales thus far, sales to China have been essentially non-existent.

–