Don Shurley, UGA Emeritus Cotton Economist

The government shutdown has paused or scaled down some USDA functions, but not all. The October supply/demand (WASDE) report was not released, weekly exports data is not available, weekly crop progress and conditions data is not available, weekly AWP and LDP/MLG data is not available. Thankfully, FSA has recently begun some operations/ functions.

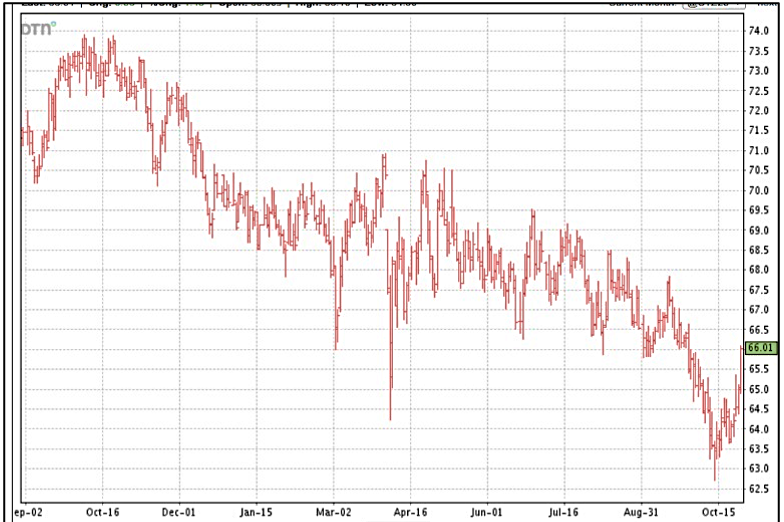

Prices (December futures), after falling to near 63¢, have shown improvement the past couple of weeks and currently stand about 66¢. This is likely due to 63¢ uncovering some demand at that low price. Also, the market is encouraged by potential progress in US-China trade negotiations.

The market may have “pent up” reaction to the lack of data when such data is available again. I’ve been asked numerous times if I think prices will improve? Farmers obviously have some tough decisions to make. Prices have been disappointing and still are despite this more recent improvement.

Farmers need cash flow. Because prices were low and growers continued to hope for improvement, I think little of the crop has been priced for delivery at harvest time. The improvement made recently fuels hope that this may be the beginning of further gains.

Will prices continue to improve? No one knows for sure, but—

It’s possible if 1—US-China trade talks are positive, and it results in cotton export sales and shipments and 2—if the US crop gets smaller when subsequent reports are available.

It’s less likely if 1—US-China trade talks disappoint and 2—if the US crop gets bigger.

It’s important to recognize that “improvement” is relative to where we’ve been. We’ve been below even the 70 to 71 cents level for almost a year—since December 2024. So, there’s likely a lot of headwind to fight off on the way back up. Even 70 to 71¢ are disappointing and worrisome price when you consider costs and break even levels. New crop, December 2026 futures are below 70¢. December 2025 futures were .~ 73¢ last year at this time.

I’ve seen some commentary that mentions the typical seasonal low in price that happens at harvest, due to increased supply and the flood of crop coming in. That doesn’t apply here. Yes, the crop is coming in—but very little of it is already priced and committed for delivery. And with prices being so low, it’s not likely that much of it is going to be priced and sold at harvest.

The problem is low demand, not too much supply. If demand were better and buyers had markets waiting on the crop, the lack of delivery commitments would likely be enough to drive price up and/or the basis improve. It’s harvest and I’d venture to say that most producers may have very little if any of the crop priced for delivery. Yet, cash flow is likely a need. “Have prices finally bottomed out?” Even so, that’s not the issue. How much improvement is possible and are you willing to take the risk and defer selling until later, and what are your choices of how to do this?

There may be others, but I can think of 3 ways to defer until later but provide some cash flow now.

1-store the crop under Loan

2-enter a “deferred price” or “on-call” or “provisional” contract using a more distant futures

3-sell the crop and buy a Call Option on a more distant futures

–

Each of these choices has advantages and disadvantages—they’re not perfect and you’re taking risk on an unknown future. But each will work—provide cash flow now but defer the market outcome until later. Otherwise, your only option is to sell now and be done. That’s the zero-risk choice, but unfortunately that’s sure not a pretty picture.

–

This content is for informational and educational purposes only. The author, Don Shurley, is solely responsible for the content. Neither the author nor Southern Cotton Growers (SCG) assume responsibility for decisions made and actions taken as a result of this content. Any data included is obtained from sources believed to be reliable, but its accuracy and completeness is not guaranteed by Southern Cotton Growers (SCG) or the author. The content and opinions expressed are those of the author, and not SCG.

- Surprise!January WASDE Report Moves Corn and Soybeans Lower – Cotton Flat - January 16, 2026

- Don’t Ignore Cow Size When Comparing Calf Weaning Weights - January 9, 2026

- Federal Estate Tax and Gift Tax Limits Announced For 2026 - December 19, 2025