Don Shurley, UGA Emeritus Cotton Economist

In 2026, provisions of an improved ARC/PLC income safety net and higher loan rates in the OBBBA will fully kick in. Payments from the 2025 crop year will be received in October 2026. Producers will receive Bridge Payments. Improved crop insurance adjustments were also made by the OBBBA.

Will 2026 be better than 2025? Well, we haven’t yet said anything about costs and prices. All these things are needed and good and welcome, but they’re each temporary to some degree. They’re band-aids on a much larger problem. Agriculture needs higher commodity prices and improved profitability.

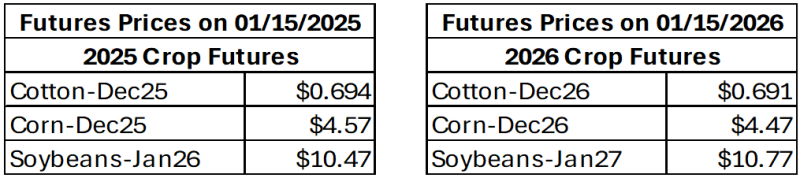

Prices are essentially about where they were last year at this time. Cotton, about the same; corn down a little; and soybeans up a little. Currently, compared to last year (and this does not consider the basis), cotton has gained a little relative to corn and has declined a little relative to soybeans.

Peanut acreage (and production) increased last year—prompted by low prices for competing crops like cotton. Peanut price has since declined. So, how will producers respond? There is no futures market for price discovery for peanuts. With a large supply of peanuts and with cotton price still low, what price will peanut buyers need to offer to entice enough peanut acres to be planted and how many acres will that be?

USDA’s January crop production, supply and demand numbers are considered “supportive” for cotton but not so for some other crops. Corn has dropped roughly 18 cents (or 4%) and soybeans 10 cents (or only about 1%).

To summarize USDA’s January cotton numbers compared to last month’s December estimates:

- Planted acreage for 2025 was lowered 20,000 acres but harvested acres increased 43,000 acres.

- Expected average yield was lowered by 73 lbs/acre. Yield was reduced in 6 states—Texas, Arkansas, Florida, Louisiana, Mississippi, and Tennessee.

- So, the 2025 US crop was reduced 350,000 bales.

- Projected US exports for the 2025 crop marketing year ending July 31 were unchanged.

- World production was lowered 360,000 bales. China was increased 1 million bales, but the crop was lowered in the US, India, and Turkey.

- World use/demand was increased 310,000 bales—accounted for mostly by increase for China.

- World Ending Stocks reduced approximately 1½ million bales.

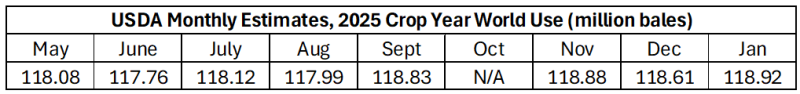

The market is waiting on evidence that cotton demand is improving. In recent years, we often have seen USDA’s demand estimates adjusted downward as we proceed through the marketing year. This weakens price. Thus far for the 2025 crop year, demand estimates have been fairly stable at between 118 and 119 million bales. Since the estimates began last May, USDA’s demand forecast has increased 4 out of 8 months. We really need to see demand break 119-120 million bales.

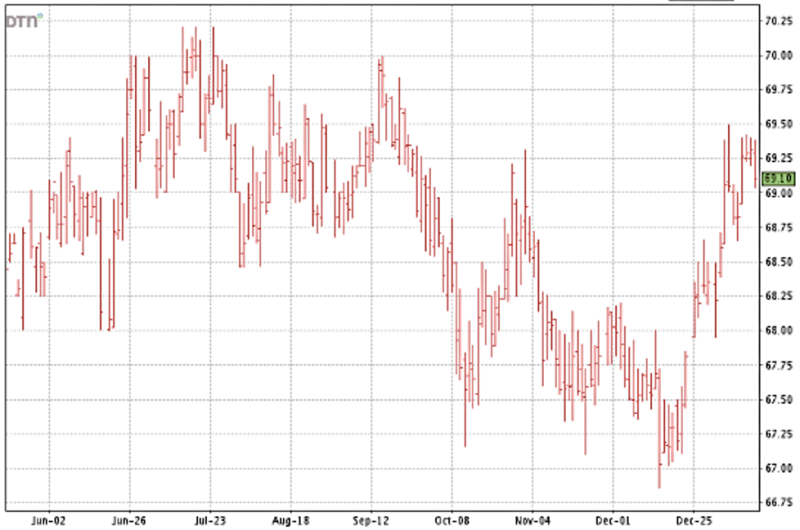

Prices (new crop December 26 futures) are currently in the 69 cents area. While this is not near what we hope it will be and can be, price has improved 2 cents in recent weeks. Price is now higher than it has been since the end of September.

Moving forward, the market will be watching for further revisions in 2025 crop year projections, 2026 planting intentions, and weekly exports and evidence of improving demand.

–