Don Shurley, UGA Emeritus Cotton Economist

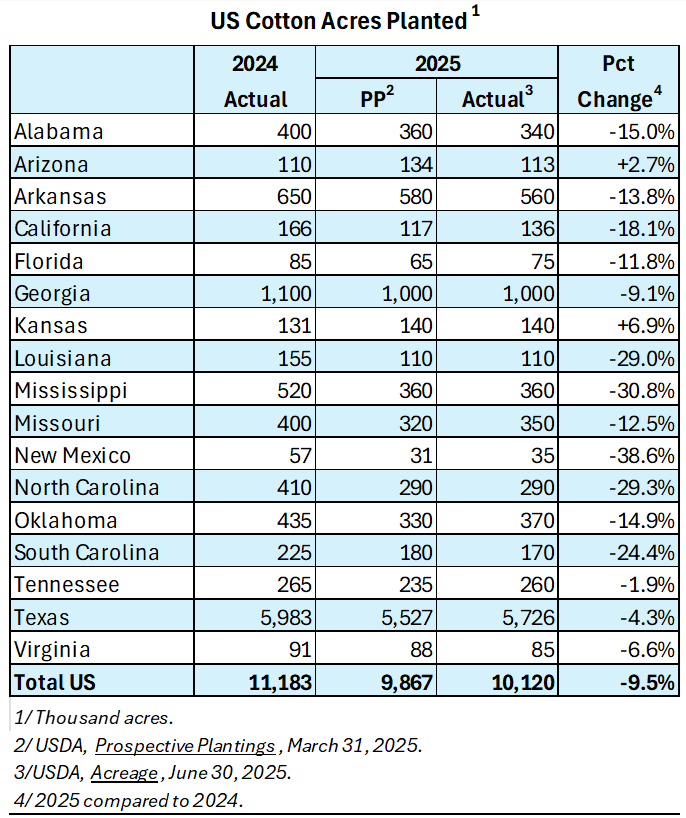

Back in March, farmers said they intended to plant 9.87 million acres of cotton this year. If realized, that would be an 11.8% reduction from last year. Prices have not improved since then and expectations were that acres actually planted would be even lower than the March estimate. So, the contents of the acreage report came as a big surprise to me.

The June 30 Acreage Report was USDA’s first estimate of actual acres planted. That number was 10.12 million acres—253,000 acres more than the earlier March intentions number. This is higher than most observers and analysts thought it would be. Most believed actual acres planted would be less than what farmers back in March said they intended to plant.

Acres actually planted are estimated to be lower than March intentions in only 5 of 17 states. Texas was 200,000 acres higher than March intentions, and this explains most of the increase. 2025 acreage is estimated to be down 9.5% from last year. Acres planted are down in all but 2 states with acres shifting to corn, soybeans, and peanuts. In some situations, acres will remain unplanted.

As we now move forward, the market will focus on crop condition, acres likely to be harvested, and yield. The acres planted will eventually be revised to conform with FSA certified acres and BWEP enrolled acres. In Georgia, for example, BWEP enrolled acres are less than 800,000 as of June 13 compared to USDA’s estimated 1 million acres planted. Total US acres may eventually be revised down, closer to March intentions or lower.

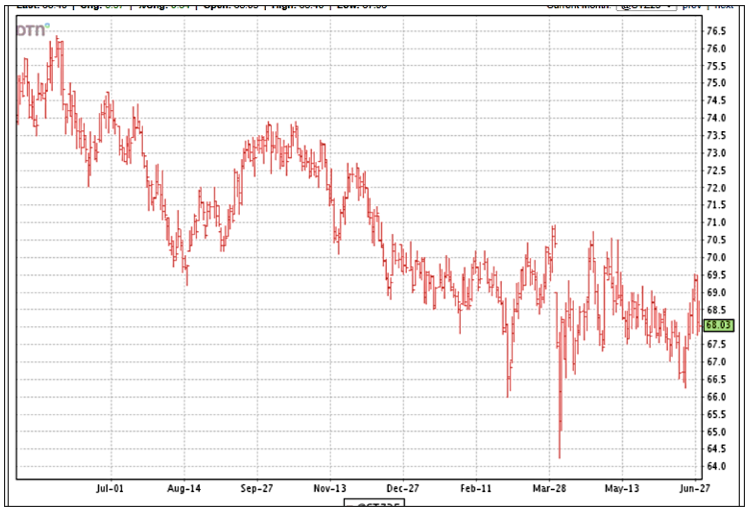

Prices (December 25 futures) initially have lost 1.29¢ on the bearish (higher than expected) acreage number. December is currently in the 68¢ neighborhood.

It is likely that prices will continue to trek within the 67 to 71¢ range. Price could be mostly in the lower end of that range, and threaten to break even lower if crop conditions and yield outlook are good. Eventually, acreage (planted and expected to be harvested) revisions will also come into play.

As of June 29, the crop is rated 17% poor or very poor and 51% good or excellent—both higher than the previous week. Texas was rated 25% poor or very poor.

Exports have been good enough that USDA could revise their estimate for the marketing year up slightly. This would be supportive of price.

–

- Federal Estate Tax and Gift Tax Limits Announced For 2026 - December 19, 2025

- Why Do I Have So Many Open Cows? Causes of Reproductive Failure - December 19, 2025

- Wiregrass Cotton Expo Offers Resources, Research, & Real Solutions for Growers in Southeast – January 22 - December 19, 2025