Don Shurley, UGA Emeritus Cotton Economist

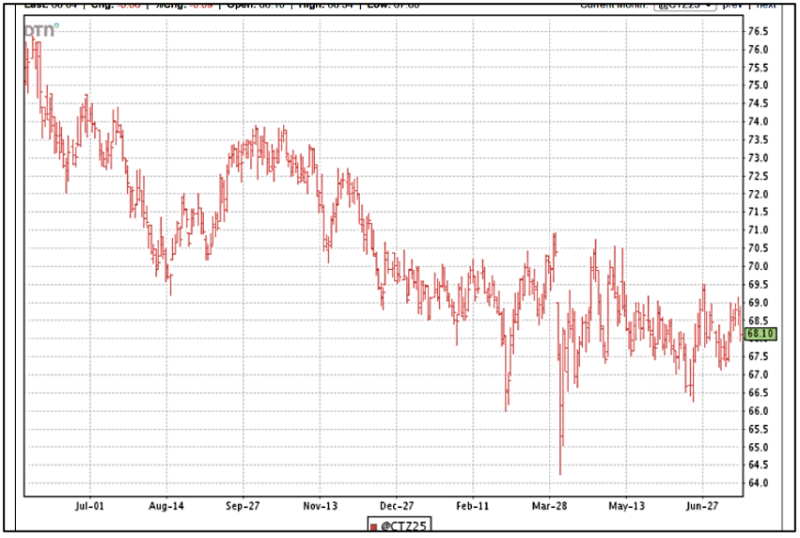

Cotton prices (December 2025 futures) continue in the mostly 67¢ to 71¢ range. Thus far, nothing has been able to push prices higher for the past 7 months. We’ve had a few dips below this range, but prices recovered quickly.

For the producer looking for 2025 crop opportunities in the 70’s (and who isn’t), it’s been an agonizing and disappointing journey so far. Few growers will contract in the 60’s and instead will choose to wait and hope for something better. Some may have taken protection with Puts, however.

USDA’s July production and supply/demand numbers are pretty much a non-factor. There are a few changes worth noting and keeping track of but nothing of major consequence.

- Exports for the 2024 crop marketing year which ends July 31, were increased 300,000 bales to 11.8 million bales.

- The projected 2025 crop was increased to 14.6 million bales—up 600,000 bales from the June estimate.

- Exports projected for the 2025 crop year were unchanged at 12.5 million bales.

- World production for the 2025 crop was raised 1.43 million bales from the June estimate. This is accounted for by expected increased production from the U.S. and China.

- China’s projected imports for the 2025 crop year were lowered 700,000 bales.

- World Demand/Use was increased 360,000 bales from the June estimate. The increases were for Pakistan and Mexico.

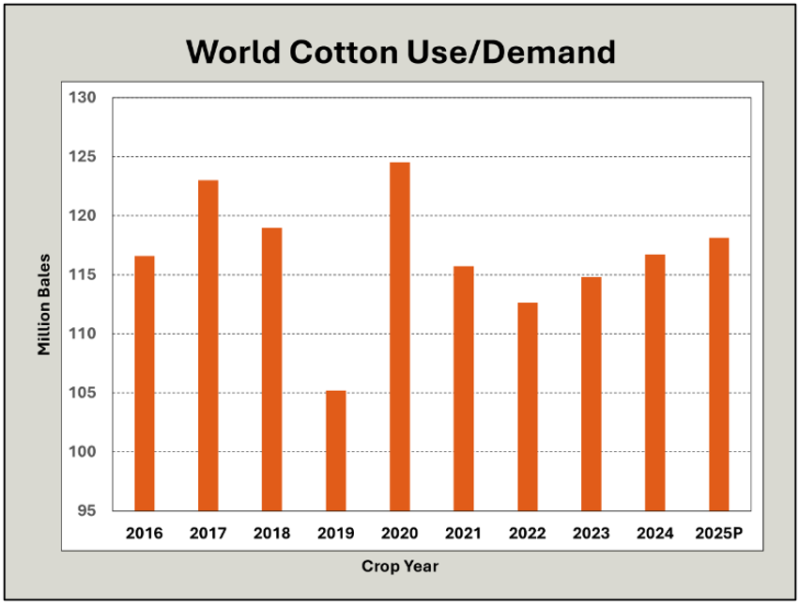

After the big COVID pandemic decline in 2019, Use rebounded strongly in 2020 but then declined in 2021 and 2022. Since then, Use has now increased 3 consecutive years (2025 projected)—averaging a 1.6% increase per year.

While this is good, it has yet to translate into stronger prices for U.S. growers. This is likely due, at least in large part, to 1) market uncertainties during the year, and 2) loss of World export market share (to Brazil). I would not consider cotton’s market demand to be “back” or “resurgent” until World Use is at 120 million bales or better. Use is projected at 118.12 million bales for the 2025 crop marketing year.

So, what’s ahead? I’m trying to look for anything that could possibly give us an increase in price.

- I continue to believe that U.S. acres are less than the June 30 Acreage report number. Firsthand knowledge based on other reliable data—the USDA projected Georgia acreage (1.0 million), for example, just is not there.

- Exports for the 2025 crop year are expected to be 700,000 bales (5.9%) higher than 2024. We really need to do that or better. We’ll keep track of the weekly numbers.

- Especially if U.S. acres are less than currently projected, crop conditions will be even more important, if exports are good.

As of July 20, the crop is 13% poor and very poor and 57% good to excellent. This is improved over recent weeks. Texas is 18% poor and very poor, down from 25% earlier. Tennessee is 25% poor or very poor.

–

- Federal Estate Tax and Gift Tax Limits Announced For 2026 - December 19, 2025

- Why Do I Have So Many Open Cows? Causes of Reproductive Failure - December 19, 2025

- Wiregrass Cotton Expo Offers Resources, Research, & Real Solutions for Growers in Southeast – January 22 - December 19, 2025