Don Shurley, UGA Emeritus Cotton Economist

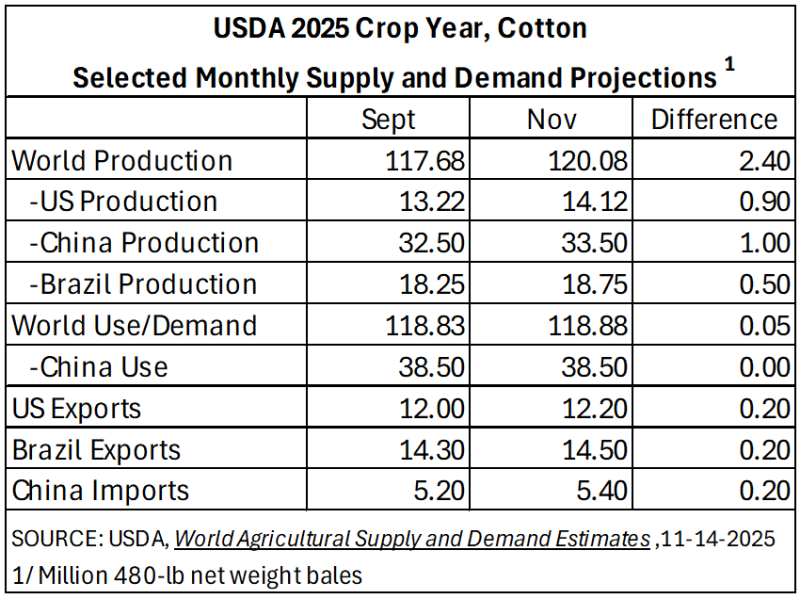

Due to the U.S. government shutdown, some agencies and their data reports have not been available since September. USDA today released the November U.S. and World supply and demand estimates and crop production projections.

Being in the middle of the U.S. harvest season, without crop updates and estimates, it was uncertain how and in which direction prices would react once data became available again.

In short, World production was increased and demand was not. This widens the overproduction gap between how much is produced vs how much is needed.

U.S. exports for the 2025 crop marketing year were increased 200,000 bales. Brazil exports were also increased by the same amount. China’s imports were increased 200,000 bales.

The U.S. crop being increased 900,000 bales is a bit of a surprise. Some observers and analysts were expecting the crop to move lower. Estimated acres planted and to be harvested were unchanged from the September report, but yield was increased in 13 of 17 states. In some states, expected average yield was increased quite substantially.

These higher-than-expected yields, if realized, are much needed and will help cover costs… if only the price were better. This larger US crop may dampen prices somewhat but I’m sure growers are happy to have the pounds.

–

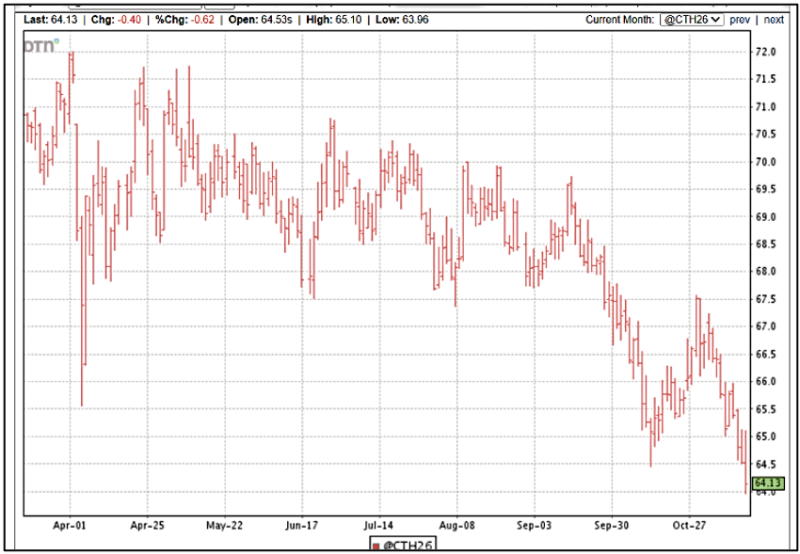

Prices (March 26 futures) have trended sharply lower over the past 2 weeks. Prices reached life-of-contract lows this week with 4 consecutive daily declines Tuesday-Friday. Mar26 now stands at just over 64 cents. The larger US crop, lack of demand growth, and lack of positive cotton news in US-China trade negotiations are weighing on the market.

I believe little of the crop is already priced and committed for delivery. Most growers will likely choose some way to defer and hope prices improve and sell later.

–

- Surprise!January WASDE Report Moves Corn and Soybeans Lower – Cotton Flat - January 16, 2026

- Don’t Ignore Cow Size When Comparing Calf Weaning Weights - January 9, 2026

- Federal Estate Tax and Gift Tax Limits Announced For 2026 - December 19, 2025