by Hannah Baker | Jun 20, 2025

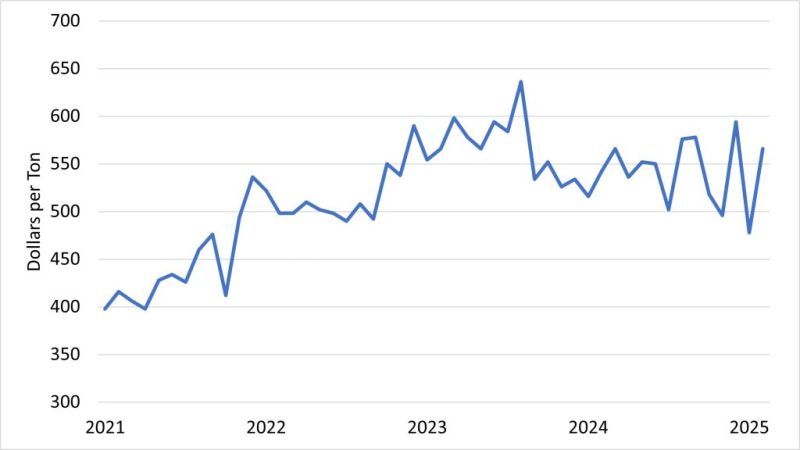

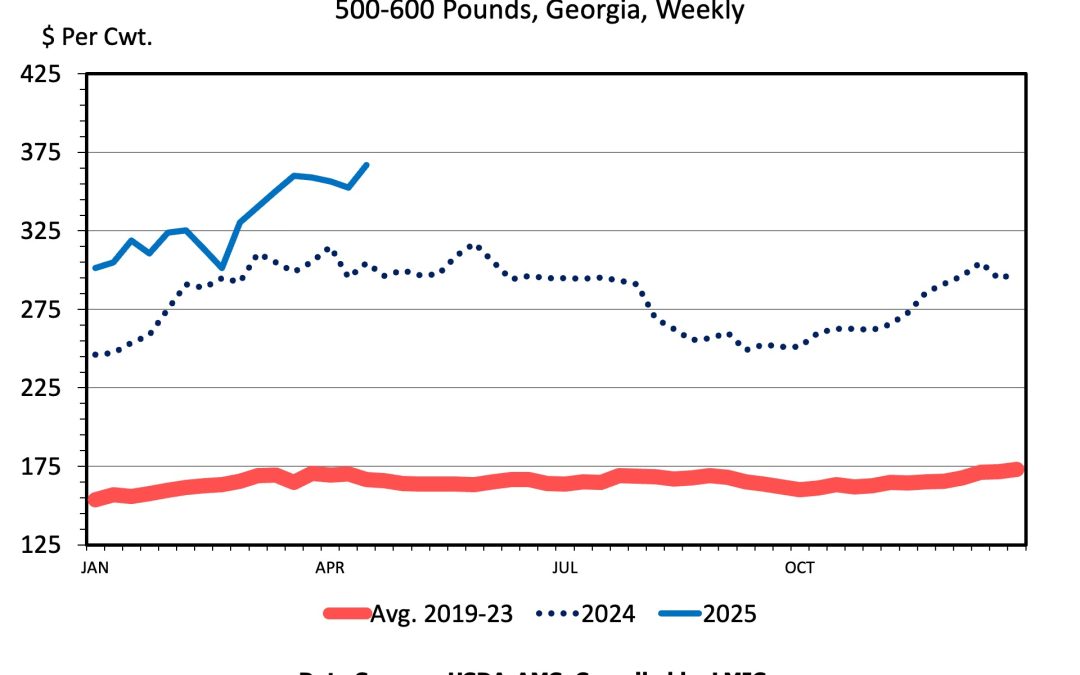

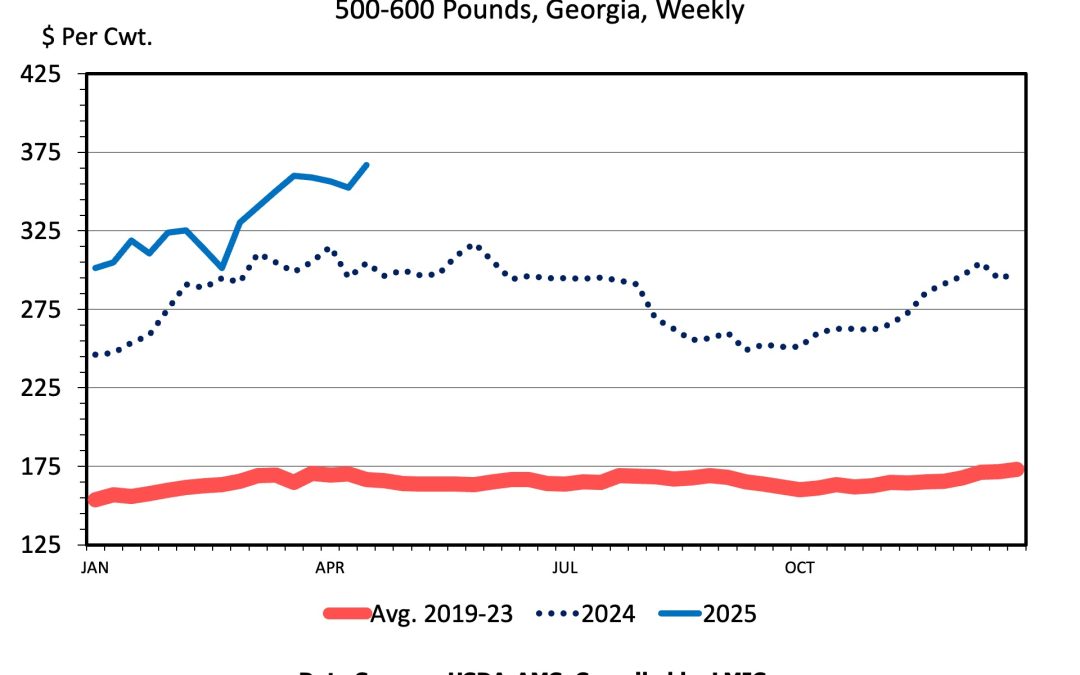

Due to current inventory levels, producers are beginning to think about expansion. Because of this, the value of young cows and heifers is increasing as demand for breeding stock increases. On average, bred heifers are selling between $3,500 – $4,000 per...

by external | Jun 20, 2025

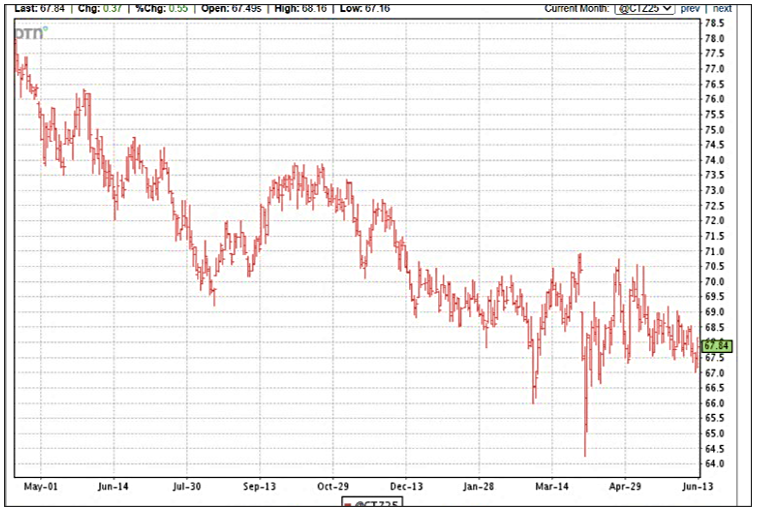

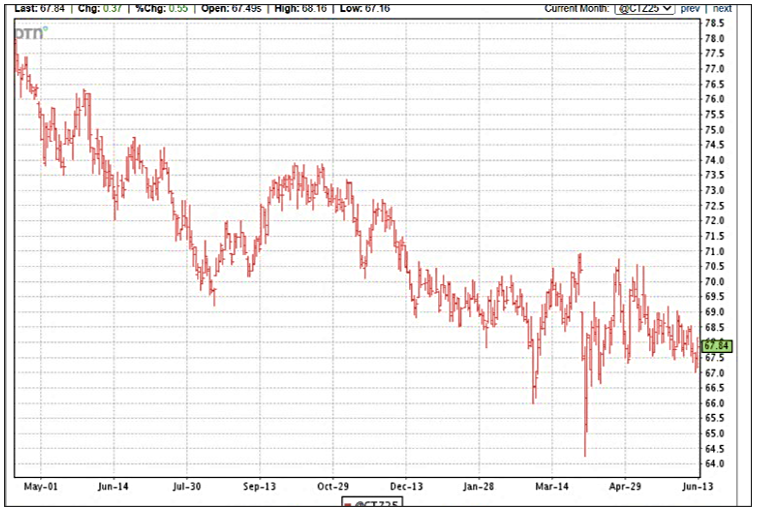

Don Shurley, UGA Emeritus Cotton Economist Last week’s USDA monthly supply/demand estimates for June do not contain enough good news to support higher prices. But also, there’s not enough negative news to call for price to move lower. So, prices (December 2025...

by Hannah Baker | Jun 6, 2025

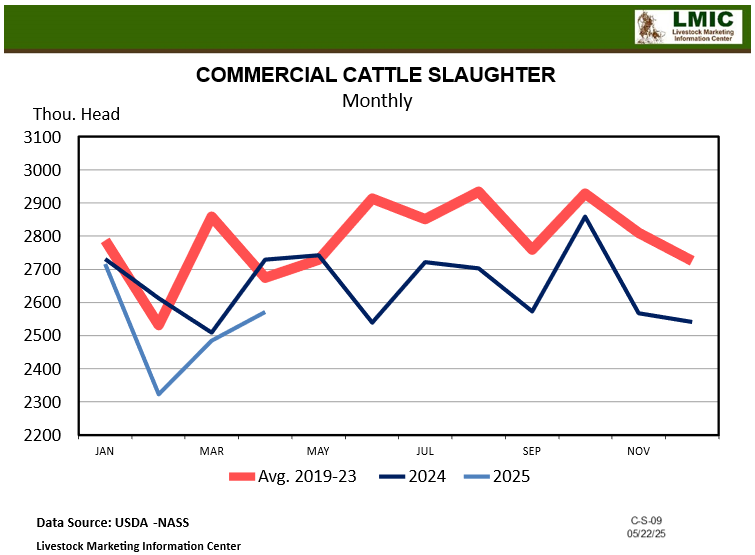

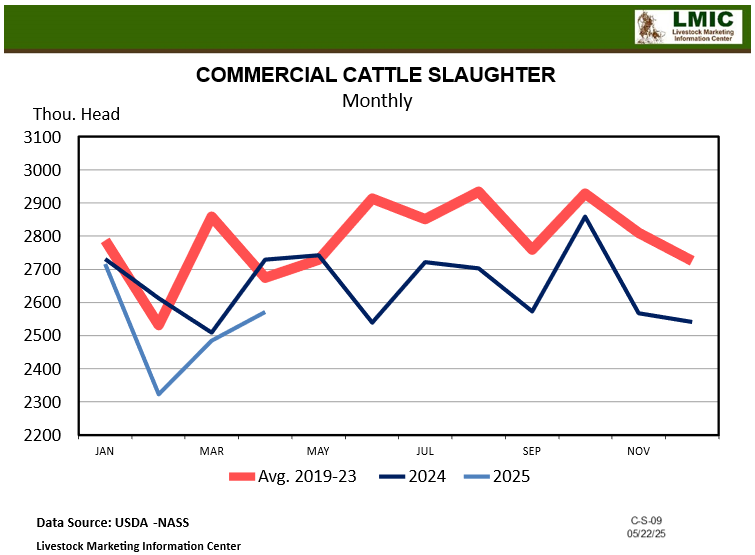

Livestock slaughter in the first quarter of 2025 (January-March) totaled at 7.38 million head, down 4% from the first quarter of 2024. Cow slaughter, beef cow slaughter, and heifer slaughter in the first quarter were all lower year-over-year. Beef cow slaughter...

by Hannah Baker | May 2, 2025

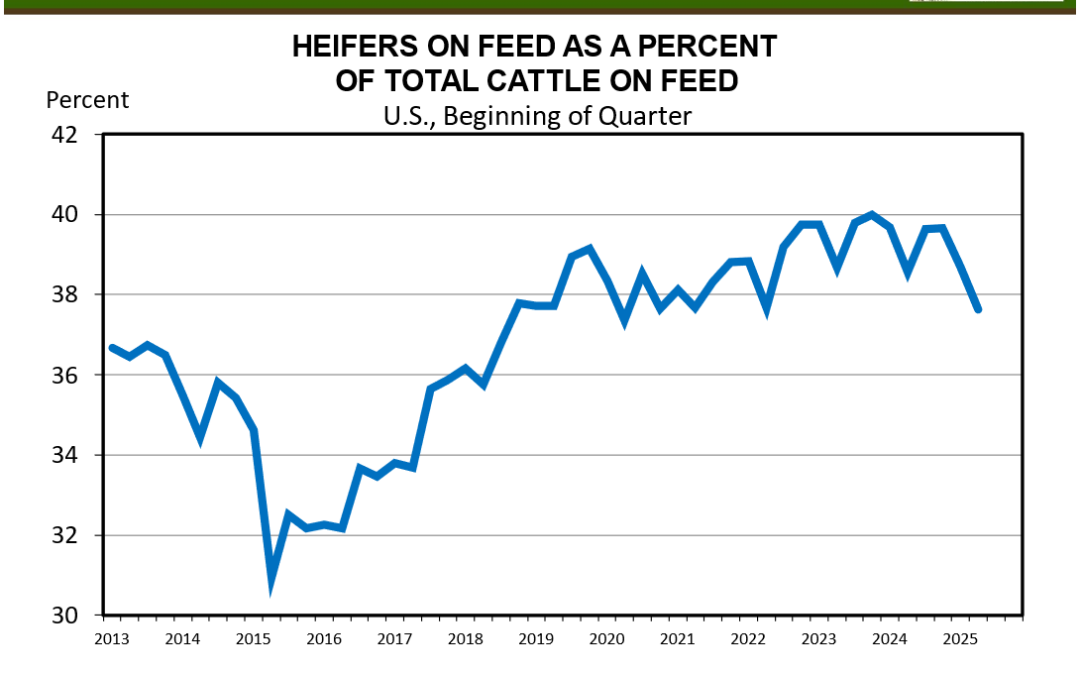

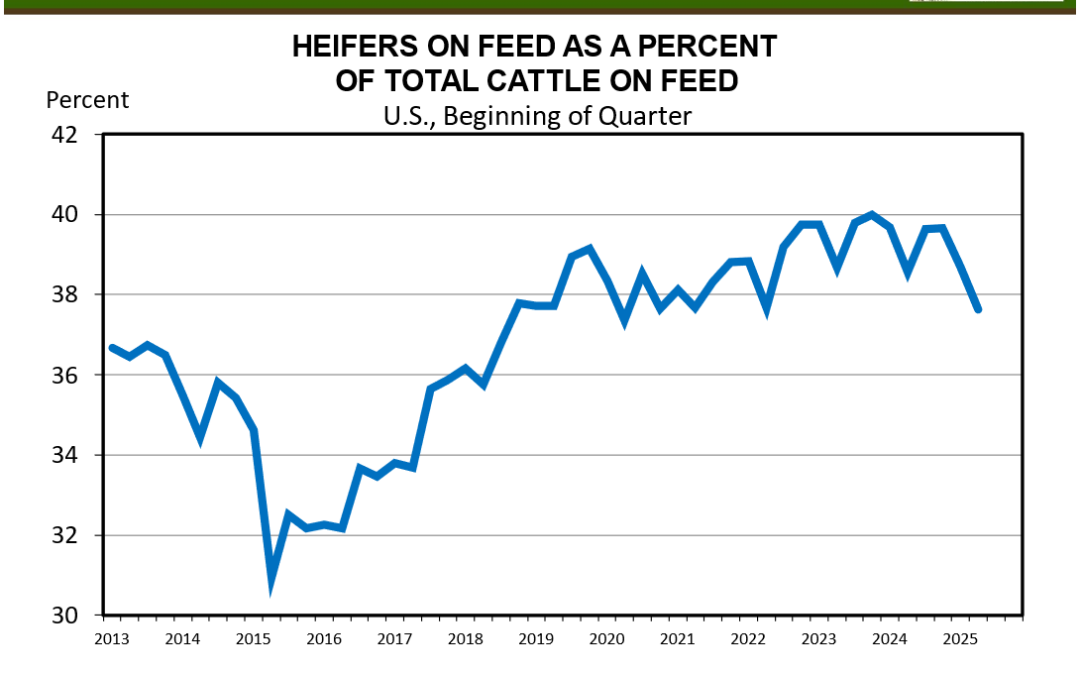

Heifers on Feed: Not as Many, but Still Too Many Every month, USDA-NASS releases the Cattle on Feed Report indicating how many cattle are on feed, how many have been placed, and how many have been marketed. The April report showed that cattle and calves on feed in...

by external | May 2, 2025

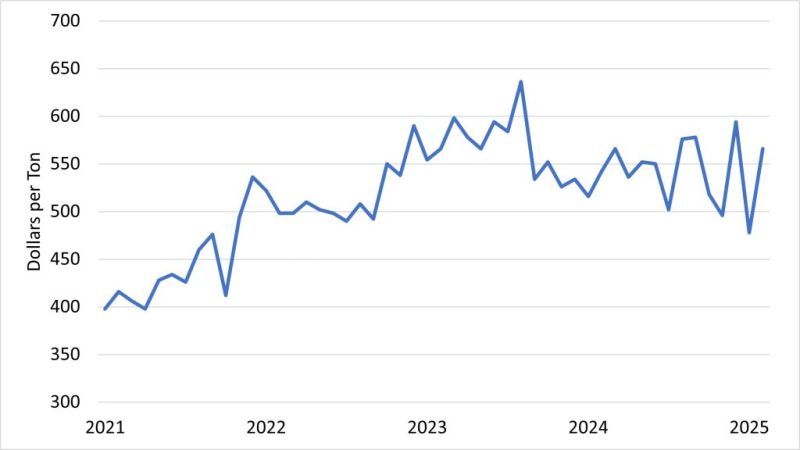

Kevin Athearn, UF/IFAS Regional Specialized Agribusiness Agent, North Florida Research and Education Center – Suwannee Valley Prices for stored peanuts remain relatively strong, but projected increases in peanut acreage this year dampen the outlook for the 2025...

by external | May 2, 2025

David Anderson, Texas A&M Livestock and Food Product Marketing Specialist, Southern Ag Today – April 29, 2025 The cattle market has experienced a lot of volatility in recent weeks, especially in the futures market, due to tariff announcements and recession...