Don Shurley, UGA Professor Emeritus of Cotton Economics

Ten days ago, my headline said “Prices Should Begin to Find Direction Soon”. Direction has now been realized as prices have gained significantly—giving growers new hope after we were in the upper 80’s just a few weeks ago. December futures gained 12.46 cents last week and were up the limit of another 5 cents today.

=

Crop concerns, speculative buying, and USDA’s August crop production and supply/demand estimates provided the fuel for last week’s run. This great run presents a pricing opportunity for growers who are confident enough in their crop and wish to add to previous sales.

Let’s remember, the previous dramatic decline in price was largely the result of economic and demand concerns. It seems these concerns have faded somewhat and taken a backseat. Weather concerns have moved front and center. Strong demand optimism was the reason for the increasing market last winter and spring. How far can weather concerns alone take us this time?

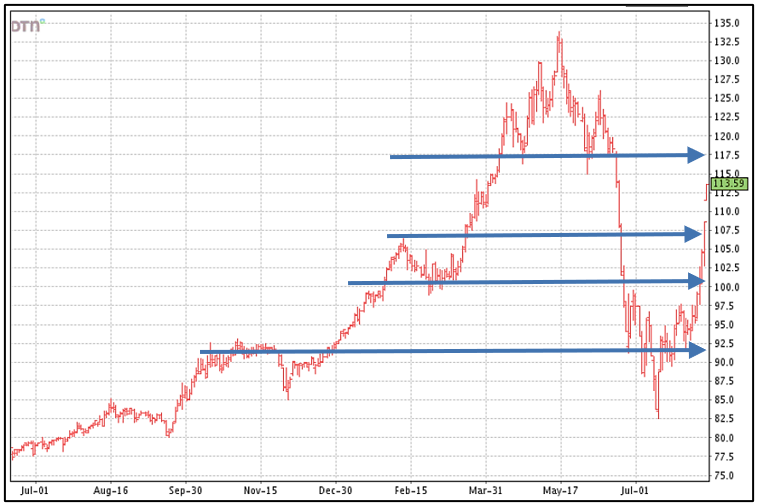

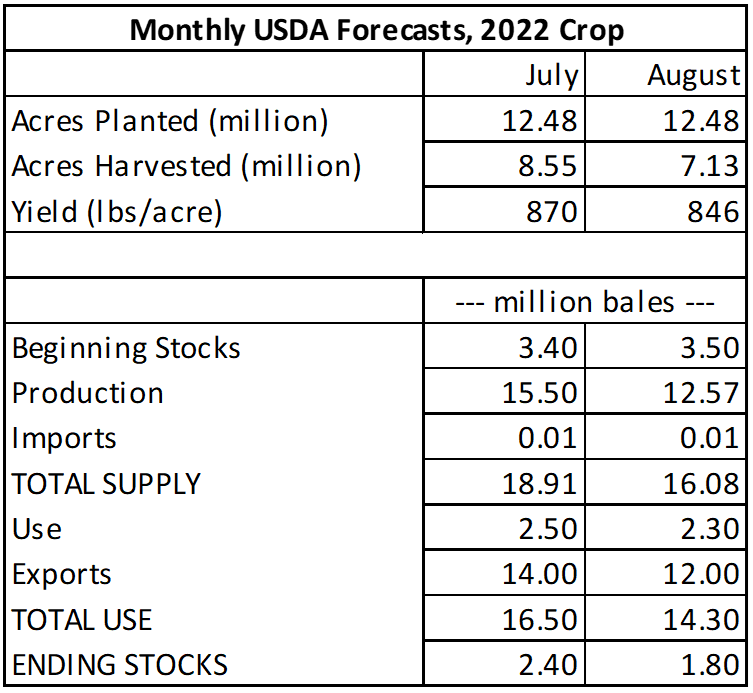

Last week’s USDA August forecasts for the 2022 crop year trimmed the crop by almost 3 million bales. This magnitude of reduction was totally unexpected. December futures stand today at 113.59. Prices could continue to move higher with “resistance” around $1.18. As we saw with the previous run up, speculative interests can move the market to levels not supported by supply and demand fundamentals, eventually subject to “adjustment”.

=

Based on the June Acreage report estimate of 12.48 million acres planted, acres to be harvested are forecast at only 7.13 million—an “abandonment” of 43%. Looking closer inside the numbers, the “abandonment” in Texas is 69%– 7.12 million acres planted vs 2.22 million acres to be harvested. We’ve had some large abandonment years in Texas historically and this would be among the highest. I wonder if the acres planted are less—which would lower the percent abandonment? Nevertheless, harvested acres and yield are what counts and this clearly shows that the situation in Texas is much worse than most observers thought.

Going forward, our attention should also be on other factors that will come into play that have been pushed to the background for now. In last week’s USDA report, World Use/demand for the 2022 crop year was reduced once again—this time by 830,000 bales.

Also, US exports for the 2021 crop year ended July 31 were trimmed 100,000 bales resulting in higher beginning stocks for the 2022 crop year beginning August 1. 2021 crop year exports are likely to get revised down further in subsequent reports. Again, this will raise beginning stocks.

There’s a saying that a short crop gets shorter. Will the US crop be cut further? August was such shocker and such a large one-time reduction, I wonder if the old saying will hold true this time.

This recovery had and has several pricing “targets”—first around $0.95 to $1.00, then around $1.05 to $1.10, and next around $1.15 to $1.18 and higher.

=

- Cotton Marketing News:Acreage Numbers are a Surprise – What Now? - July 11, 2025

- Gulf Coast Cattlemen’s Conference – August 8 - July 11, 2025

- Cotton Marketing News:USDA June Numbers—Neutral, Not Good but Not Bad - June 20, 2025