by external | May 13, 2022

Don Shurley, UGA Professor Emeritus of Cotton Economics USDA’s monthly crop production and supply and demand estimates for May, released today, show revisions for the 2021 crop and are also the first such estimates for the 2022 crop. We obviously have a long...

by external | Mar 18, 2022

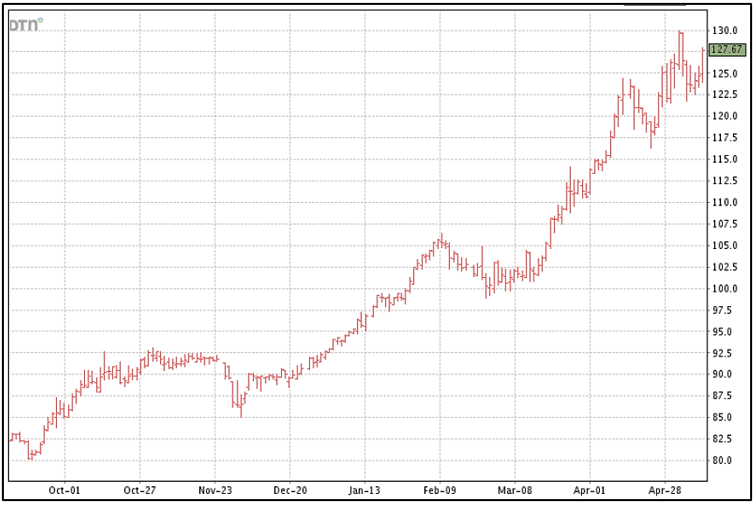

Don Shurley, UGA Professor Emeritus of Cotton Economics “Profit” = (Price x Yield) – Costs. Price is always an important part of the equation. A good year, production-wise, can be offset by low price, or higher than expected costs. Costs for 2022 will be...

by external | Mar 4, 2022

Source: USDA News Release – February 1, 2022 The U.S. Department of Agriculture (USDA) announced a new USDA Market News Mobile Application, providing producers and everyone else in the supply chain with instant access to current and historical market...

by Chris Prevatt | Feb 25, 2022

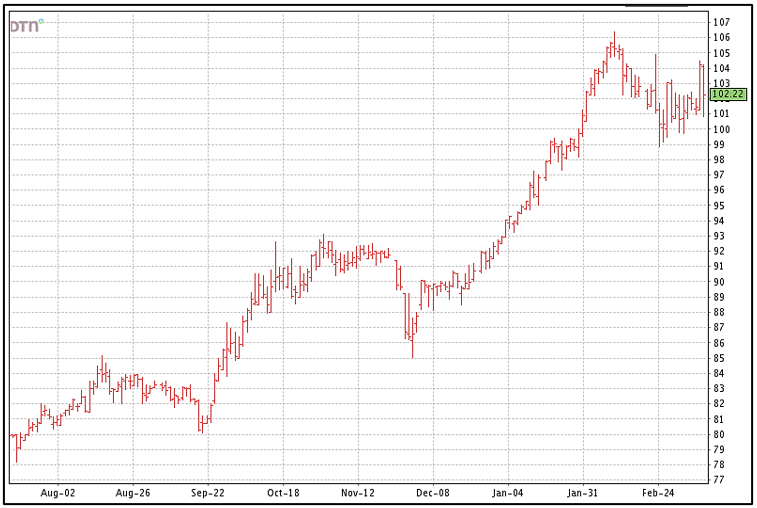

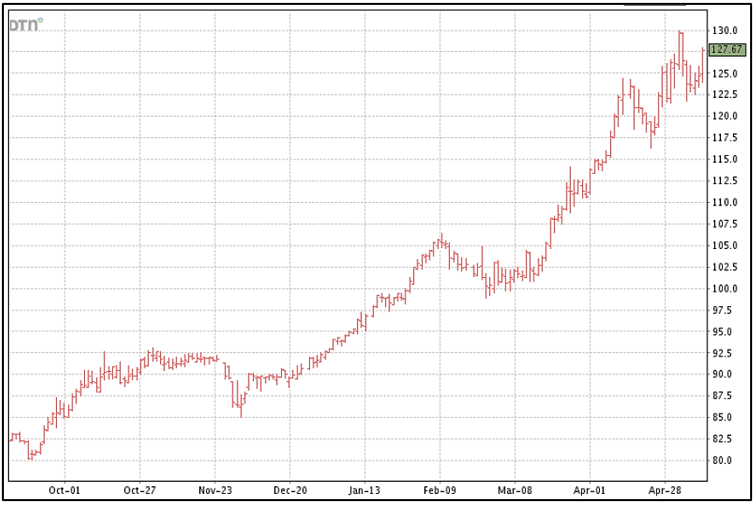

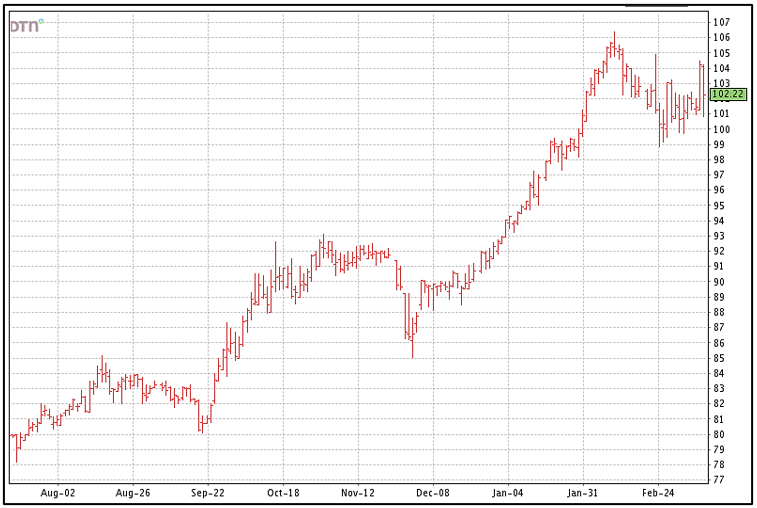

Chris Prevatt, UF/IFAS Livestock & Forage Economist, Range Cattle Research and Education Center Each year there are windows that allow producers to market feeder cattle near the high-end of the market. Cattle producers will likely be marketing cattle...

by Doug Mayo | Feb 4, 2022

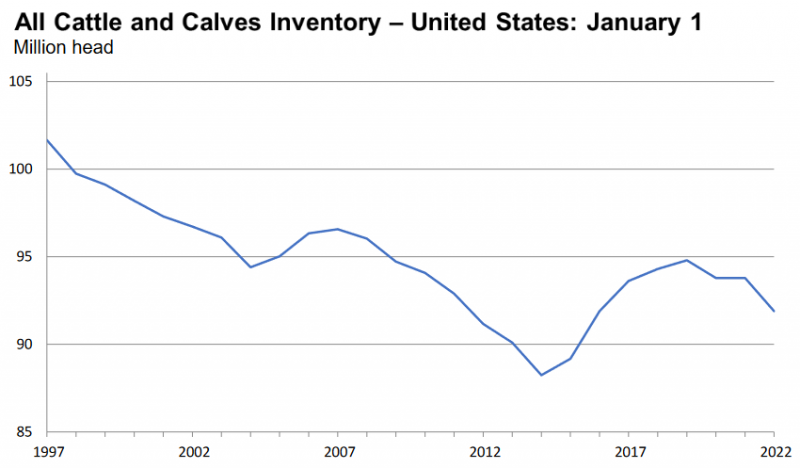

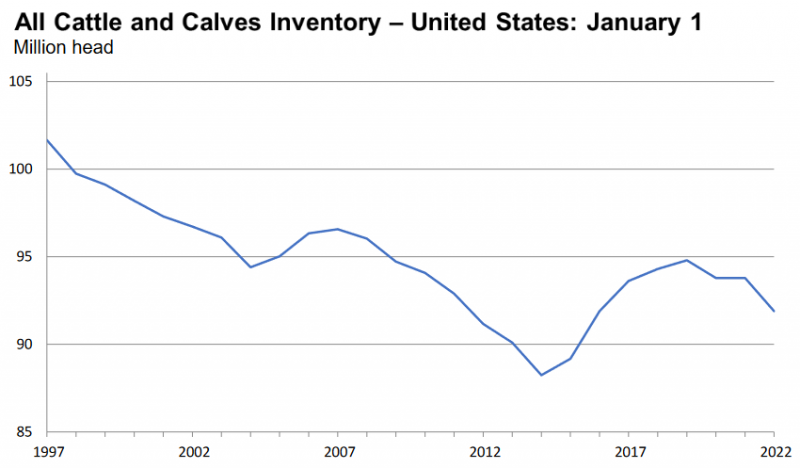

USDA’s National Agricultural Statistic Service (NASS) released the January 1 Cattle Inventory Report on January 31, 2022. These reports are a little confusing, as the year listed is the date of the report (Jan 1), but they are actually measuring the...

by external | Jan 21, 2022

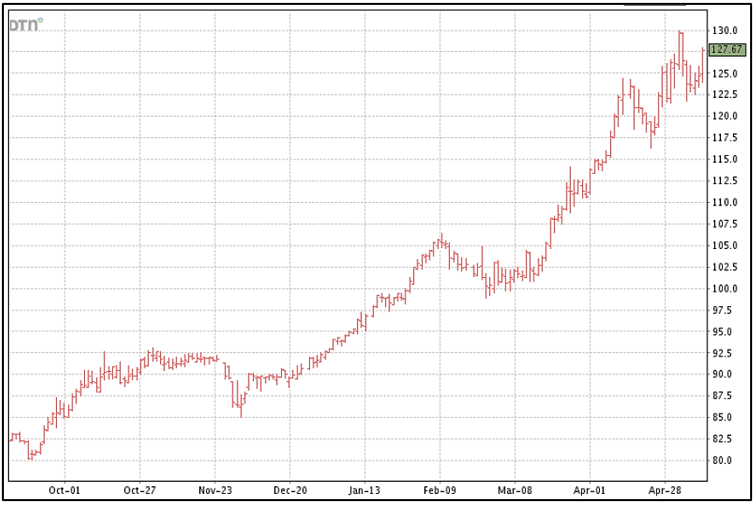

Don Shurley, UGA Professor Emeritus of Cotton Economics It’s been a very wild last three weeks. Prices have suddenly found new optimism and bullish momentum. To be frankly honest, few could have seen this coming. Now, few can know how far this will go. There are...