Don Shurley, UGA Professor Emeritus of Cotton Economics

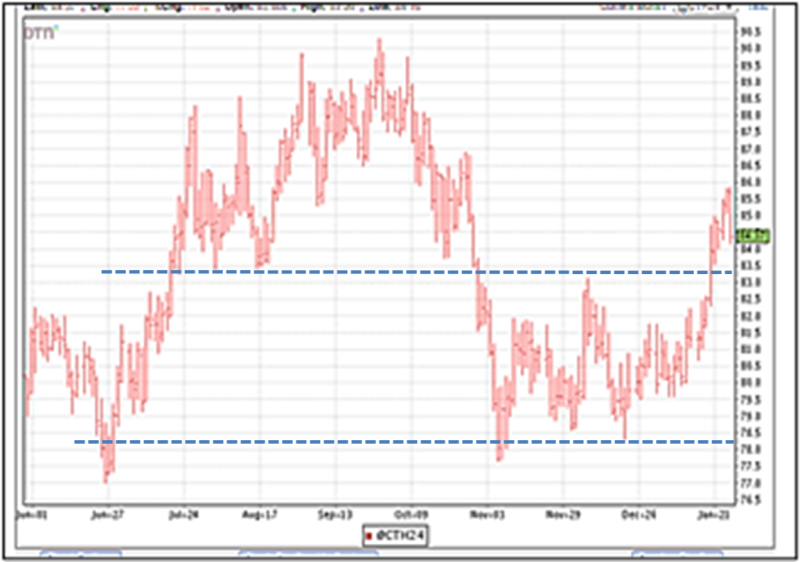

Prices (old crop March 24 futures) have finally broken to the upside and now stand within the previous 83 to 89¢ range we had for months, prior to the most recent setback to mostly 74 to 82 cents. But, that old 83 to 89¢ range will now become a barrier- that’s the way markets work, and it may be a tough nut to crack. Note, for example, that price was down sharply on Friday.

If you’re still holding old crop cotton, consider this run above 84 as an opportunity on a portion of that—depending on how much you still hold and how much risk you want to take. With the ongoing uncertainty in demand, this return to a higher price tier could challenge the sustainability of these prices.

–

Prices have shown improvement despite this month’s USDA January supply/demand numbers back on the 12th.

- The 2023 US crop was revised down 350,000 bales from the December estimate. Yield was increased but harvested acres were cut by almost 1 million acres.

- US exports for the 2023 crop year ending July 31 were revised down 100,000 bales, from 12.2 to 12.1 million bales.

- World production for the 2023 crop year was increased 260,000 bales despite the reduction in the US. The China crop was raised ½ million bales.

- World Use/demand was lowered a huge 1.3 million bales from the December projection.

- China imports were increased ½ million bales from the December estimate, up to 11.5 million bales.

Projected World Use/demand for the 2023 crop year has declined 4% or 4.57 million bales since the highest USDA projection back in June. While this would still be higher than 2022, it’s still a shock and adjustment process for prices. Projected US exports also declined from 14 million bales to now just 12.1 million.

Several factors are currently negatively impacting US cotton.

- It appears China will increase its imports but without a corresponding increase in mill use. The result is an expected increase in its stocks/reserve. While increased purchasing is good, especially if it’s US cotton, it is yet unclear if higher China stocks would be friendly to US cotton and prices.

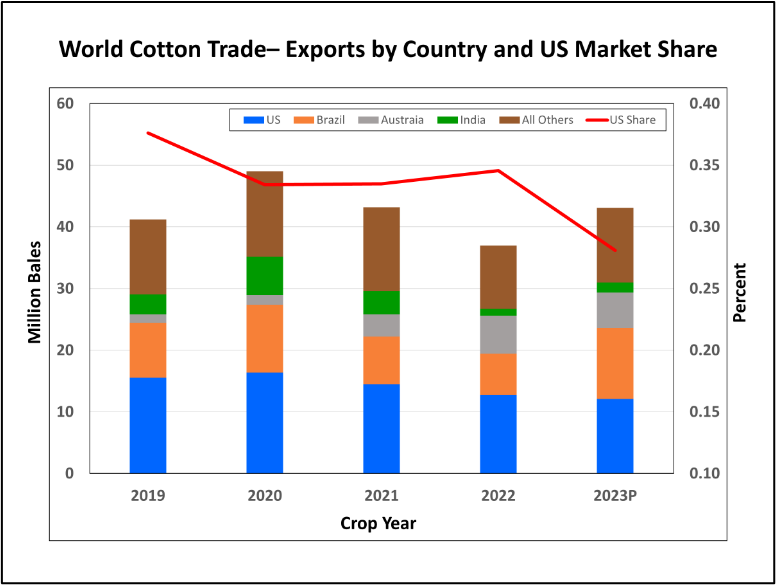

Brazil exports are expected to increase 73% this crop year. While total World exports are projected to increase, the US share of those exports is expected to decline dramatically from 34% to 28%. Brazil exports are expected to almost equal US exports for the 2023 crop year.

–

Prices will improve and be able to sustain that only when the market sees stronger mill buying. So, there is uncertainty also about the new crop. December 24 futures are currently in the 80 to 81 cents area.

Acreage planted will likely be stable to down this year. There has always been a fairly large portion of US cotton that stays in cotton pretty much regardless of price. The remaining “swing” acres could remain in cotton or go to another crop. Farmers may be looking for at least 85 cents for cotton to be competitive with other crops, but prices for other crops are not as attractive as last year.

Any reduction in planting, by itself, won’t likely stimulate prices. Demand/export buying will have to improve and solidify.

–