Old crop Mar16 futures closed today at 62.45 cents—up 1.04 cents for the week. After recently threatening the 61-cent area and even challenging 60 cents in late September, prices now seem to have found a little support and, dare we say, upward momentum. The decline of the past 2 weeks has largely been due to global and China economic concerns and declining oil prices—both impacting the stock market and other commodities.

Old crop Mar16 futures closed today at 62.45 cents—up 1.04 cents for the week. After recently threatening the 61-cent area and even challenging 60 cents in late September, prices now seem to have found a little support and, dare we say, upward momentum. The decline of the past 2 weeks has largely been due to global and China economic concerns and declining oil prices—both impacting the stock market and other commodities.

The 61-cent area seems to be holding. While this is still far below what makes everyone happy, considering this market was once thought headed for the 50’s, we take any good news we can find.

Longer term, prices still likely face “resistance” around 64 to 65 cents. If you have cotton in Loan or otherwise in storage, keep mindful that rallies to the mid 60’s or higher likely represent good price risk management opportunities. In the Loan, also be mindful of MLG or equity opportunities and remember it’s the “total money” you are trying to achieve.

In addition to price movement, basis has been improving and fiber quality premiums have been strong. Basis in the Southeast is currently +175 March for base grade 41-4/34 and premium +325 for 31-3/35. This SE basis has improved +50 points in recent weeks. Premium for 31-3/25 is +275 points in the Mid-South and +150-200 points in Texas. This is USDA-AMS data.

Estimates of possible 2016 cotton acreage will begin to get attention over the next few weeks. The National Cotton Council estimate will be released during its February 5-7 annual meeting and USDA’s first estimate will be released on March 31.

Growers planted 8.58 million acres in 2015. Early guestimates for 2016 have been mostly 9 to 9.5 million acres with some estimates below 9 and some closer to 10 million.

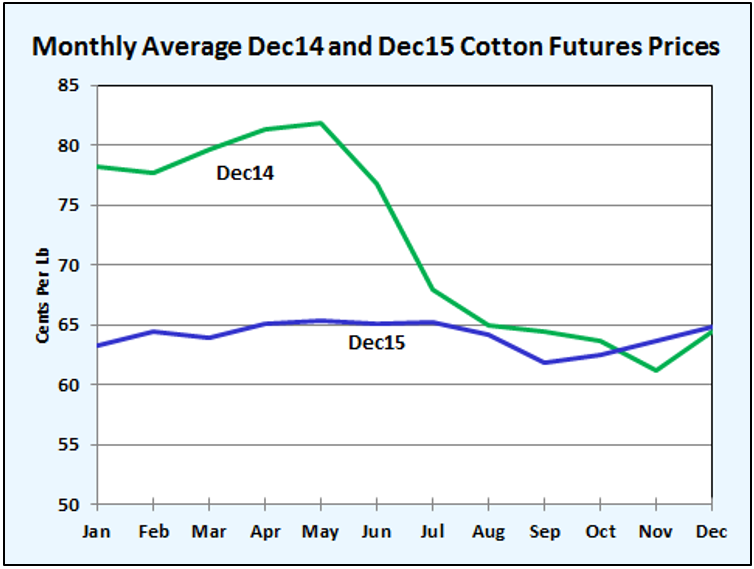

Dec16 futures prices are currently close to 63 cents—a little lower than where Dec15 futures were last year this time. Prices for the 2016 could take a path similar to the 2015 crop. The 2015 crop never could break out of a range of mostly 62 to 66 cents. The factors in play for the 2016 crop year will have to break this rut.

The cotton marketing loan LDP provides protection from low prices. Just because prices are low doesn’t necessarily translate into low/lower acreage. The LDP/MLG acts to insulate the grower from low World and US prices. When the World price (A-Index or Far East Price) falls below 72 cents, US cotton futures will be about 67 cents and the LDP increases as price declines.

Although cotton prices have remained disappointing and low, it is relative prices that are important. Compared to last planting season, cotton compared to corn is about the same. Cotton compared to soybeans—cotton has gained.

Despite disappointing prices, in addition to LDP’s, cotton has also benefited from a strong basis and good premiums for better fiber quality. There are no guarantees this continues but it is something to be considered. Newer/recently released varieties also offer both high yield potential and excellent fiber quality.

Don Shurley, University of Georgia

Don Shurley, University of Georgia

229-386-3512 / donshur@uga.edu

- 1st Quarter 2024 Weather Summary & Planting Season Outlook - April 26, 2024

- Friday Feature:Peanut Season Kicks Off at McArthur Farms - April 26, 2024

- Friday Feature:Artificial Intelligence in a Weed Control Machine - April 19, 2024