by Ethan Carter | Mar 18, 2016

Jackson County Extension hosted the 2016 Panhandle Row Crop Short Course on Thursday, March 3, 2016. Extension Specialists from Florida, Georgia, and Alabama came to relay new and pertinent information concerning crops to farmers. Attendees were able to attain CEUs...

by external | Mar 11, 2016

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist We are now two years into herd expansion and that leads to questions of how much more herd expansion is ahead and, to a lesser degree, questions about how fast remaining herd expansion...

by Doug Mayo | Mar 11, 2016

In the 1960’s, a popular TV show “Lost in Space” chronicled the adventures of the “space family Robinson” whose space ship was thrown off course by a meteor shower. Oddly, one of my favorite characters on the show was the Robot. When there was danger present, the...

by Doug Mayo | Mar 4, 2016

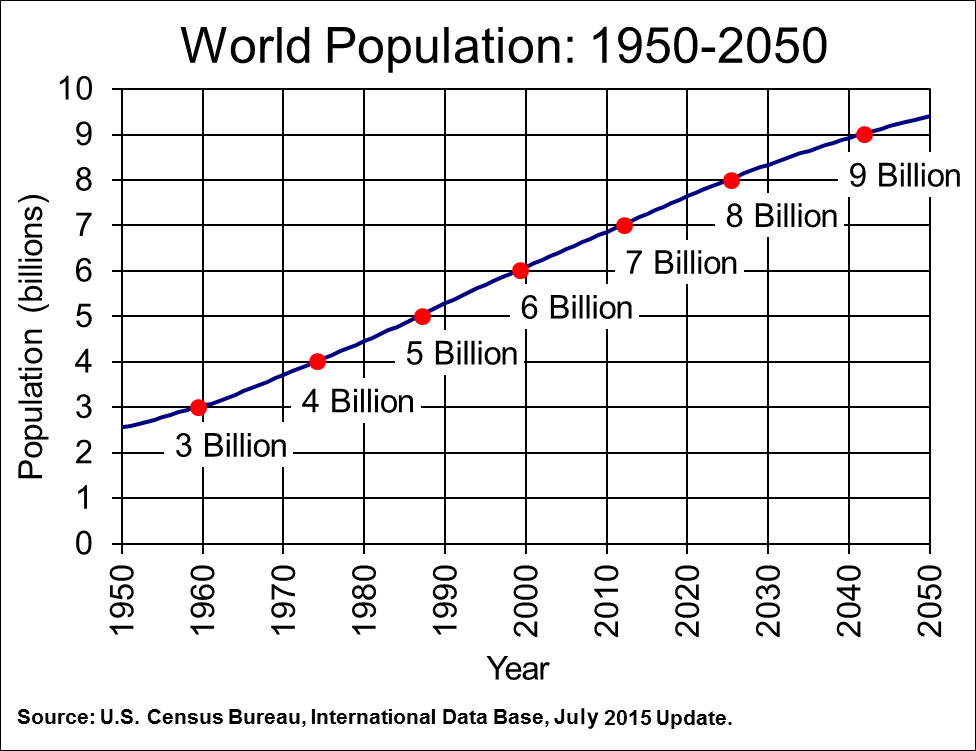

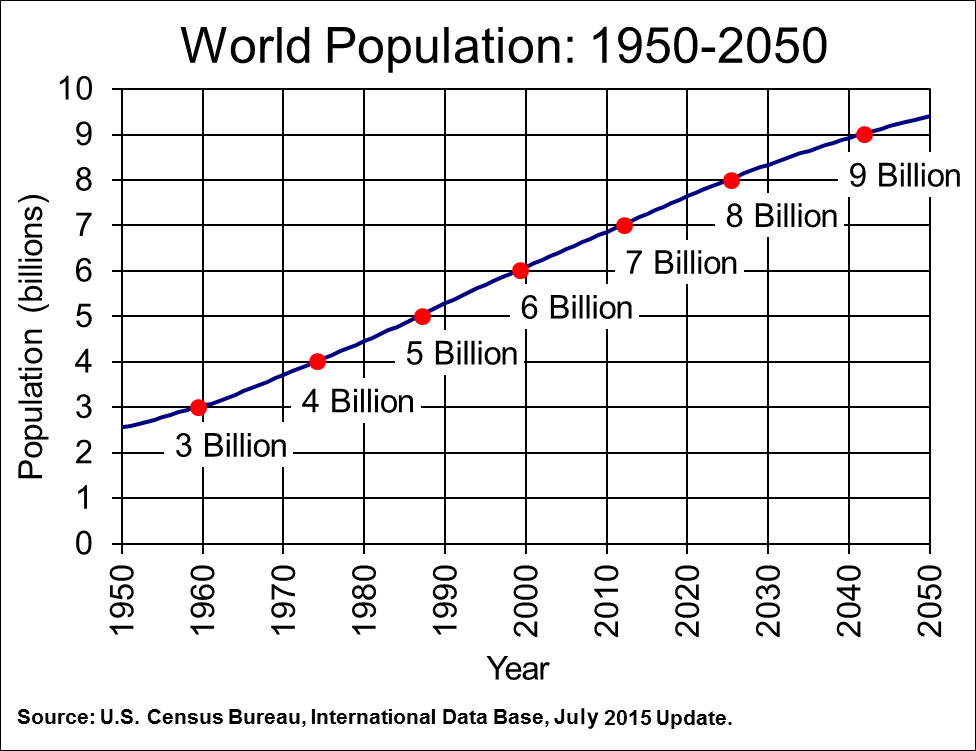

One of the areas of critical concern world-wide is how to meet the food demands for a growing world population while farmland acres continue to shrink. As you can see from the chart above, the U.S. Census Bureau is currently predicting that the world population will...

by John Doyle Atkins | Feb 19, 2016

After the 2015 growing season, depressed prices, areas of no rain for 8 weeks and yields ranging from zero to dancing around the 6,000 pound per acre mark, Santa Rosa County producers are looking toward the 2016 season with a heightened degree of concern. There are...

by Doug Mayo | Feb 19, 2016

The 31st annual Northwest Florida Beef Conference was one of the best in the long history of this event. 175 people attended the event this year that featured seven presentations and a trade show of 28 companies and organizations that provide products and services to...